Abra Global: LATAM Opportunity?

At the 10th FatAlpha Value (Cyprus) conference, one of the ideas presented was a high-yield bond of a company called Abra Global. I thought it was very interesting, so I asked Oleg about doing a podcast on it. Oleg is a professional investor with a lot of experience in special and distressed situations in Emerging Markets. Currently, he is managing his own money. The podcast recording will take place tomorrow night and will be available here a few days later.

If you are interested in hearing ideas from additional speakers who participated in the 10th Cyprus event, then register for the Online event in December, where stock ideas will be pitched by 12 professional managers and investors. Click below to check it out.

In preparation for the podcast, I’ve prepared this note. I’ll be going over this and more with Oleg, so subscribe to this SubStack so you don’t miss out.

Abra Global Ltd is the ultimate parent entity whose business focuses on Latin American airline companies. Specifically, Abra owns:

100% of Avianca, the leading Colombian airline with c. 60% market share. 177 total fleet with $5.6 billion in revenue (LTM 2Q25) and $1.5 billion in EBITDAR (26% margin). Net debt/EBITDA is 2.8x

c. 80% of Gol, a low-cost airline that is Brazil’s 2nd largest. Their Smiles loyalty program has 29 million members. 141 total fleet with $3.7 billion in revenue (LTM 2Q25) and $1.0 billion in EBITDAR (28% margin). Net debt/EBITDA 3.7x

100% of Wamos Air, a Spanish company in charter aircraft leasing and wet lease services. 13 total fleet with $0.3 billion in revenue (LTM 2Q25) and $0.1 billion in EBITDAR (31% margin).

A convertible that turns into a c. 41% in Sky Airline, a low-cost carrier which Abra says is the #2 airline in Chile and Peru.

100% of LifeMiles, the Group’s loyalty program (owned by Avianca) with 14+ million members and 340+ commercial partners. The largest in Colombia and Central America.

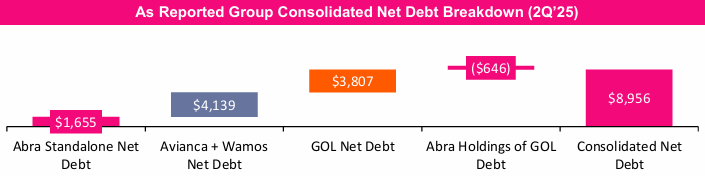

Abra has c. $9.3 billion in revenues, c. $2.5 billion in EBITDAR, and 318 aircraft with 69 million passengers (of which 43 million are loyalty members). With $9.0 billion in net debt, the Abra Consolidated Net Debt to EBITDAR is 3.6x

In particular, we are interested in the $510 million senior secured notes due 2029 with a 14% coupon (6% cash and 8% PIK).

These bonds are secured by the following:

GOL ‘take-back’ paper: $850 million debt consisting of $600 million of non-exchangeable take-back notes and $250 million in exchangeable take-back notes. Both instruments accrue interest at 9.5% and mature on December 6, 2030.

The $250m exchangeable take-back notes can be exchanged into shares of new GOL by Abra after October 31, 2027, if the equity value is at least 105% of

the then outstanding principal.

The $600m non-exchangeable bonds that amortize at $25 million per year and step up to $50 million if the exchangeable notes are converted.

All the equity in Avianca. This security is shared with the other debt ($1.9 billion total). So in case of default, you get the #1 airline in Colombia, which has had a profitable bottom line over the last 2 years, deleveraged to 2.8x, and in October was upgraded to B1 from B2 by Moody’s.

Some particulars about the issue:

The cash portion is expected to be 6% but may fluctuate. It is actually the lowest of (i) aggregate dividends received from Avianca/GOL + interest payments received from GOL debt, (ii) 6.0% and (iii) an amount that leaves Abra with a minimum unrestricted cash balance of US$50m. So the cash can be more than 6% or less than 6%. If the cash is more than 6% then the total coupon may decline to a minimum of 13% (you get less PIK). But if less than 6% then the total coupon may rise as high as 16% (you get more PIK). The 13-16% range makes sense. You get compensated according to the risk.

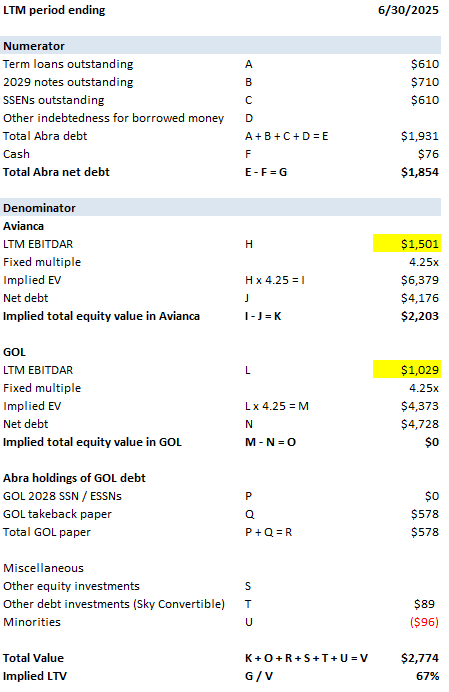

Loan-To-Value (LTV) may not exceed 100% for 15 months starting on May 21, 2025, thereafter 75%. Abra publishes quarterly the LTV.

It’s at 67% currently, as you see above. The value is purely derived from Avianca and the value of the GOL paper. GOL equity contributes zero right now to the equation. If GOL defaults, then the value of the takeback paper drops, which would increase the LTV. Assuming GOL paper drops to zero, the LTV rises to 84%.

My current understanding of GOL’s post-reorganization debt includes the exit notes of $2.1 billion, where the interest is 14.375% (paid in cash) and has a 2030 maturity. So there is c. $303m in annual interest. There are also the takeback notes that mature in 2030. There is a mandatory $25 million amortization on the takeback notes. These have a 9.5% coupon, but GOL has the option to pay-in-kind (if paid in cash then it’s an additional c.$80m or BRL 0.4b). Finally, there are leases to pay. If we look at 2Q25, we see BRL 705,430 (less than 6 months) and BRL 683,663 (6-12 months), so let’s say there is a total of BRL 1.39 billion over a year. The $303m interest + $25m amortization = $328m (or BRL 1.8 billion). So it looks like GOL will have at least BRL 1.8 billion + BRL 1.4 billion = BRL 3.2 billion payments (pre-CAPEX). There was c. BRL 1.9 billion in CAPEX in the last twelve months (LTM) so a likely spend is BRL 3.2b + BRL 1.9b = BRL 5.1 billion (without considering working capital). If we add the takeback interest are at BRL 5.5 billion, which is equal to the LTM EBITDAR (BRL 5.5 billion). Keep in mind this is an approximation.

In addition to the 14% coupon, there is a potential bonus where the holders of the notes may get equity as well. This equity top-up is delivered if:

Debt reaches final maturity: October 22, 2029

If Abra decides to pay off the notes early, either partially or in full. However, the prepayment applies only after October 2026 (24 months after the issue date).

This can be delivered in shares (up to 320,540,552 shares) or in cash, which is determined by a pre-defined “equity component schedule”. The value goes up every quarter post October 2026. It starts at $9.7m and reaches $611.3m on maturity.

If, however, the bonds are called before October 2026, then there is no equity top-off. So essentially, the company is incentivized to call the bonds. And this could happen if there is an IPO.

Assuming the bonds are called, then the company will need to pay 106.50. Considering the bonds are trading around 98, then a current holder would make around 8.5 points from the call + 14 points from the coupon = roughly 22.5 points for holding for 1 year. So 23% for a one-year holding period sounds pretty interesting to me!

Of course, this discussion is missing a few details, such as Colombian risk. I intend to ask my guest about his thoughts on the opportunity, the company story, the industry, sovereign EM risk, and more. Stay tuned!

Find your next idea, chat with experts, and join our community of investors.

Check it out: https://fatalphavalue.com/online

Disclaimer: Not investment advice. Do your own work! This substack is not operated by a broker, a dealer, a registered investment adviser, or a regulated entity. Under no circumstances does any information posted represent a recommendation to buy or sell a security. In no event shall the author be liable to anyone reading this post for any damages of any kind arising out of the use of any content available in this post. Past performance is a poor indicator of future performance. All the information on this substack and any related materials is not intended to be, nor does it constitute investment advice or a recommendation. All materials and information you obtain here are exclusively for informational purposes and do not constitute an offer or solicitation to provide any investment services to investors based in the U.S. or elsewhere.

Thanks for the analysis. Looking forward to the podcast!