Smoking is horrible and can lead to cancer. I don’t smoke. As a teenager, I spent weeks every year raising money for the Anti-Cancer Society. But smoking is not going away. It’s like gambling. Some investors stay away from tobacco stocks. I haven’t, however, I considered them more of a trade rather than a long-term investment. Some of these companies pay good dividends, and the market, at times, can overly punish them. Let’s take a “First Look” at Imperial Brands, whose stock has been soaring.

Known for brands such as Winston and Davidoff, the company (like most in the industry) is trying to transition to non-combustibles. These are only 4% of net tobacco revenues but have been growing at double digits. In this analysis, I won’t be pinning my hopes on future success but will focus on what I know.

For the record, management guidance for the next 5 years is for low single-digit growth in combustibles, double-digit growth in NGP (next generation products), adjusted EPS growth of at least high single digits, £2.2b to £3b of free cash flow annually, buybacks every year, and dividends. (Click here to check out their Capital Markets Day that took place on March 25th).

Market Info

Ticker: LSE:IMB (Capital IQ)

Stock Price (Local): 29.71

52-W High (April-15-2025): 29.63

52-W Low (April-16-2024): 17.02

5 Year Beta: 0.28

Avg Volume (3-month, millions): 2.4

Avg Volume (USD, millions): $92.4

Shares outstanding (basic): 815

Country of Incorporation: United Kingdom

Trading Currency: GBP

Filing Currency: GBP

Enterprise Value

(Figures on the left are in USD, and on the right are in GBP)

Market Cap (millions): $31,854 | £24,069

Plus: Total Debt $12,736 | £9,502 of which Leases $517 | £386

Plus: Minority Interest $787 | £587

Less: Cash and ST Investments -$1,532 | -£1,143

EV (millions): $43,844 | £33,015

Key Valuation Metrics

P/E forward: 9x

EV/EBITDA forward: 7.8x

Dividend Yield: 5.2%

Key Persons

CEO & Director: Bomhard, Stefan

CFO & Director: Paravicini, Lukas

Investor Relations Director: Durman, Peter

Board of Directors, Chairman: Esperdy, Therese

Top Holders

Capital Research and Mgmt 11%

Dart, Kenneth Bryan 7%

BlackRock, Inc. 7%

The Vanguard Group, Inc. 5%

Dodge & Cox 5%

FMR LLC 5%

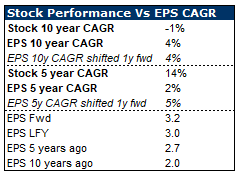

Performance

The stock has done well if you got long recently, but has been flat for the last decade. Fortunately, there has been a dividend (currently at 5.8%). So even if the company continues to grow at low single digits, the total return may not be so bad. Entry level does matter here because someone who got long at £17.10 is earning a 10% dividend yield.

While the stock is recording a multi-year high, it is still below its peak, which was over £40. See below.

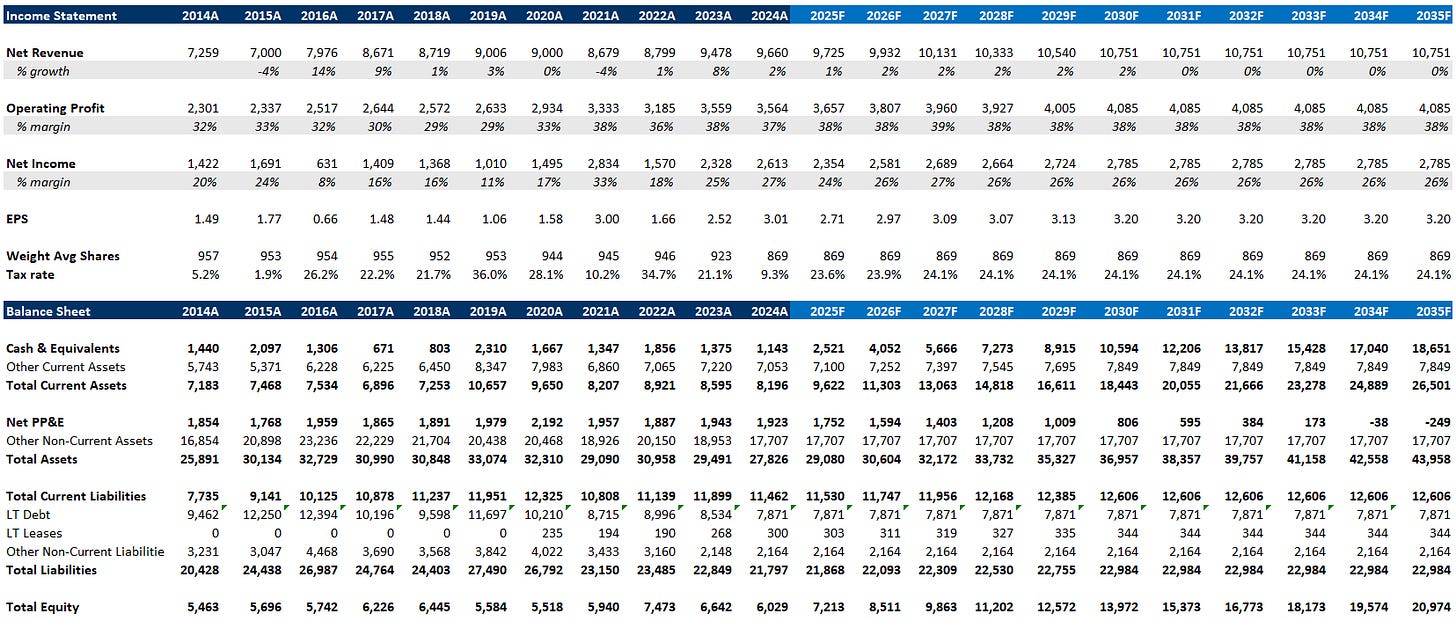

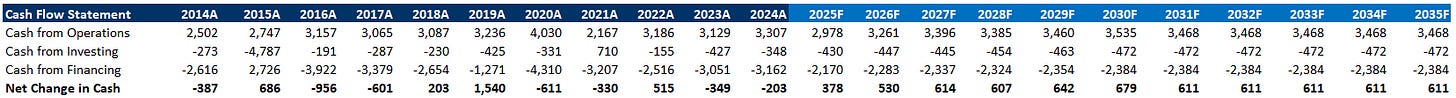

Forecasts and DCF Valuation

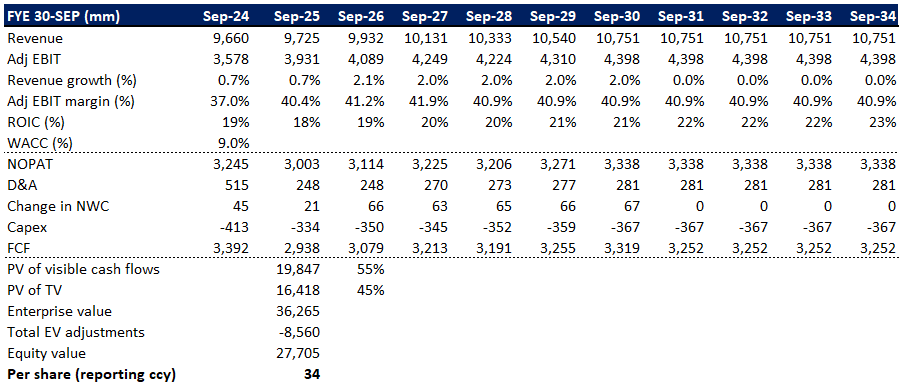

I took consensus estimates for revenue for 2025-27, then assumed 2% for 2028-30. I looked at the data for price and volume over the last decade. On average product prices rose c6% while volume has declined by around -4% annually. Therefore, 2% makes sense. From 2031 onwards, I assume zero growth. I chose this approach in order to offset a potential acceleration in volume decline due to demographics. (Old people who are smokers die and are not replaced). Another risk is the profitability of the NGPs that are currently loss-making for the company.

If you are looking at the tables below and are confused by the revenue numbers, please note that I am showing net revenues. This is what the company and analysts are using, while the accounting top line is gross (before duties).

My DCF calculates FCF above consensus, which is just below £3b (I’m not above). However, I’m sure my zero-growth in the long run offsets sell-side assumptions. My intrinsic value calculation comes out to £34 compared to a market price of £30

An alternative way to think about the valuation is a zero-growth perpetuity with a 9% WACC and a £3b FCF assumption. That gets you to exactly the current market value. Ultimately, the deciding factor here is qualitative rather than quantitative. If you think the decay in volume continues at a slow pace and Imperial Brands will eventually be able to substitute its earnings stream with NGPs then this is interesting for sure. If you think someone else will be the winner in the non-combustibles and eliminate competition, such IMB, then it’s a pass.

Do you think IMB will survive? Leave your thoughts in the comments!

18/04/25 UPDATE: Posted an additional article on Tobacco here.

Disclaimer: Not investment advice. Do your own work! This account is not operated by a broker, a dealer, a registered investment adviser, or a regulated entity. Under no circumstances does any information posted represent a recommendation to buy or sell a security. In no event shall the author be liable to anyone reading this post for any damages of any kind arising out of the use of any content available in this post. Past performance is a poor indicator of future performance. All the information on this substack and any related materials is not intended to be, nor does it constitute investment advice or a recommendation. All materials and information you obtain here are exclusively for informational purposes and do not constitute an offer or solicitation to provide any investment services to investors based in the U.S. or elsewhere.