Akamai in Plain English

Prep work before my Podcast with Steve Gorelik

Tomorrow I’m doing a podcast with Steve Gorelik of Firebird Management. We will be discussing Akamai Technologies, so if you have any questions for Steve, then please post them in the comments section. Steve is a smart investor who does very in-depth analysis. I had invited him to speak at the Online event I’m organising in December, but he unfortunately has a conflict. In preparation for the podcast, I prepared this short intro on the company that I’m sharing with you. Make sure you subscribe so you don’t miss the episode.

And if you are interested in the Online event, then click on the image below:

Per the company, they “develop and provide solutions for global enterprises to build, secure, and accelerate their applications and digital experiences. Its massively distributed global network is comprised of core and distributed compute sites, more than 4,300 edge points-of-presence in approximately 130 countries and over 700 cities.”

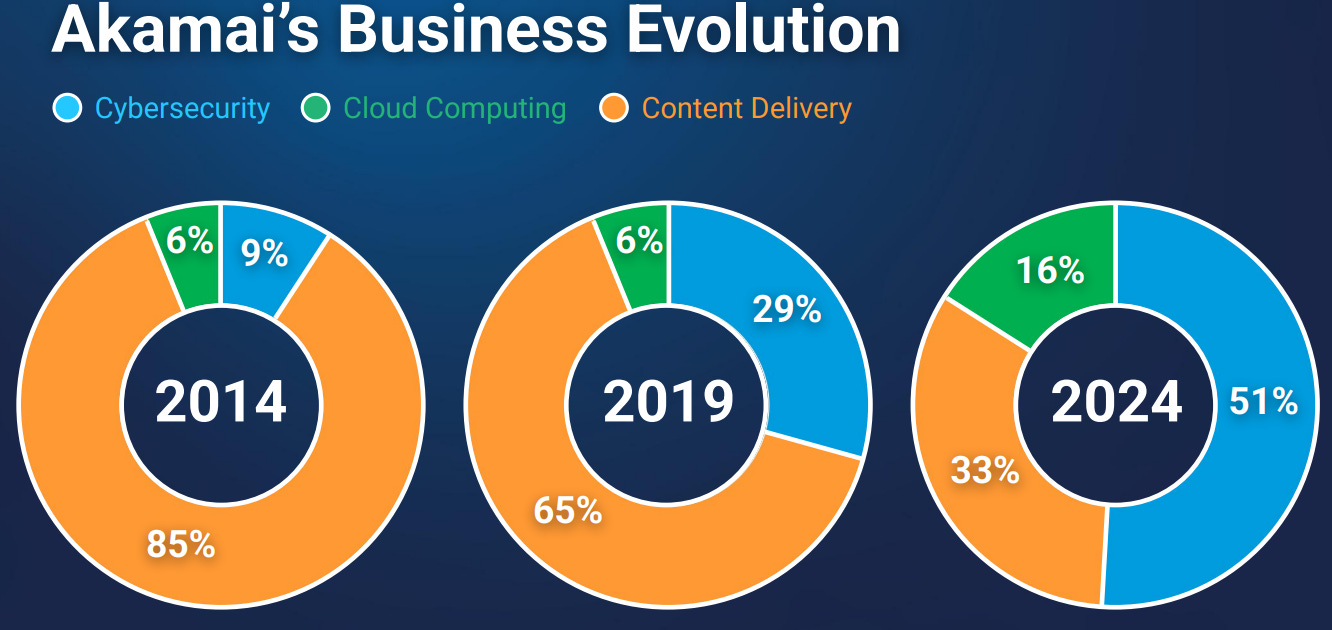

🤦♂️What? Anyway, after some digging, I started to understand what they do. They operate 3 segments: Cybersecurity, Cloud Computing, and Content Delivery. The company mainly focused on content delivery (85% of 2014 revenues), but Cybersecurity is now its main business line. The company talks about its transformation here: Akamai: Navigating the Cloud Frontier — A Transformation from CDN to Distributed Cloud Provider

Market Info

Ticker: AKAM

Stock Price: $90.61

52-W High (February-10-2025): $103.75

52-W Low (April-09-2025): $67.51

5 Year Beta: 0.70

Avg Volume (3-month, millions): $2.1

Avg Volume (USD, millions): $186.1

Shares outstanding (basic, millions): 143.9

Country of Incorporation: United States

Trading Currency: USD

Filing Currency: USD

Enterprise Value

Market Cap (USD, millions): $13,035.6

Plus: Total Debt $5,231.1 of which Leases $1,088.8

Less: Cash and ST Investments: -$1,118.7

EV (USD, millions): $17,148.0

Key Valuation Metrics

P/E forward: 13x

EV/EBITDA forward 9x

Dividend Yield: 0.0%

Key Persons

Co-Founder, CEO, President & Director: Leighton, F. Executive

VP, CFO & Treasurer: McGowan, Edward

COO & GM of Cloud Technology Group: Karon, Adam

Board of Directors, Chairman: Hesse, Daniel

Top Holders

Vanguard: 13%

BlackRock: 10%

State Street Global Advisors: 5%

First Trust Advisors: 4%

Geode Capital Management: 3%

Leighton, F. Thomson: 2%

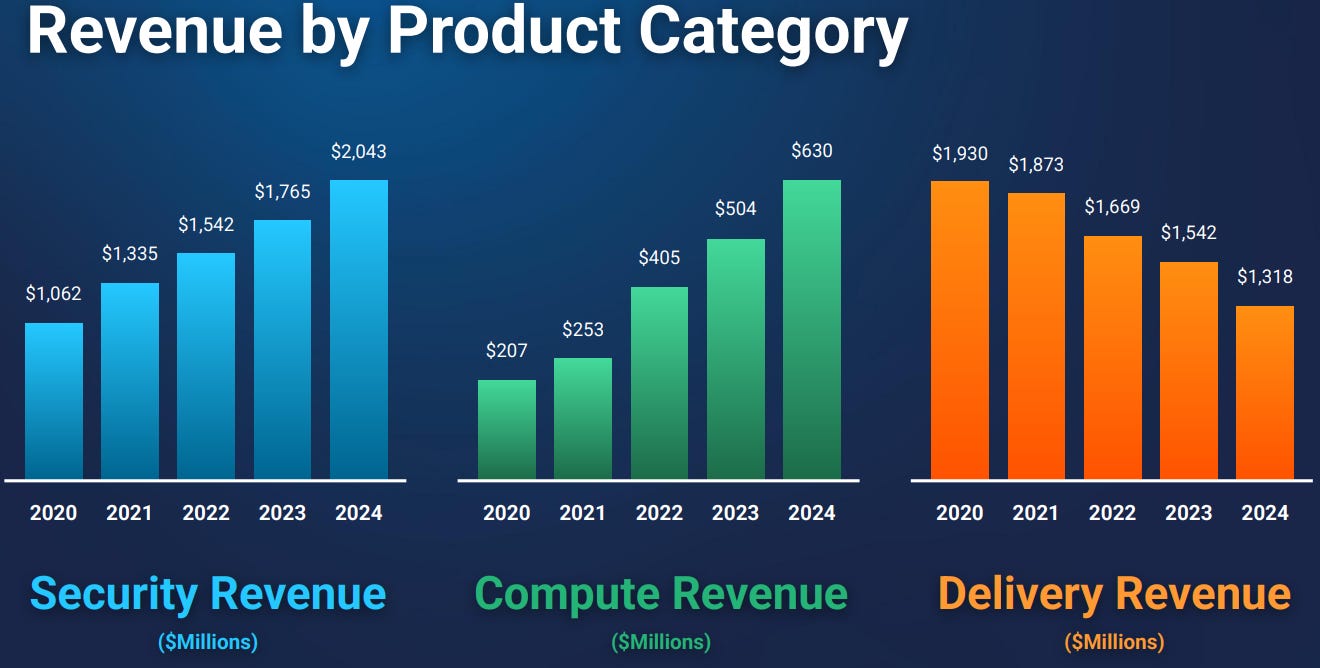

Content Delivery: Companies pay Akamai to cache/serve their web content closer to users so that it loads faster. For example, a streaming service pays Akamai to distribute video files globally so that the viewers don’t experience a lag. This segment is under pressure with revenues declining. Expectations are for flat to down single-digit growth. Fortunately, the other two segments are growing. See below:

Security: The company offers a bunch of services such as firewalls, API protection, DDoS (denial of service) protection, bot protection, and zero-trust security. In today’s world, this is probably more important than physical security. It’s not just people who are getting hacked (sidenote: I still don’t understand how my maxed-out ‘Clash of Clans’ account was stolen 😢), but all websites are constantly under attack (sidenote 2: multiple failed attempts to log in to my own website). This segment is expected to grow around c. 10%

Cloud Computing: This segment allows customers to run virtual machines and other services on Akamai’s distributed platform close to the end-user. This segment is expected to grow quickly with Cloud Infrastructure Services ARR (Annual Recurring Revenue) at 40-45% by year-end, while the overall segment has been guided to grow just under 15%.

Performance

I wish we had done this podcast a couple of weeks ago because they announced November 6th, and the stock popped significantly. The company reported an earnings beat, and analysts upgraded the stock. In a brief chat, Steve believes there is more upside!

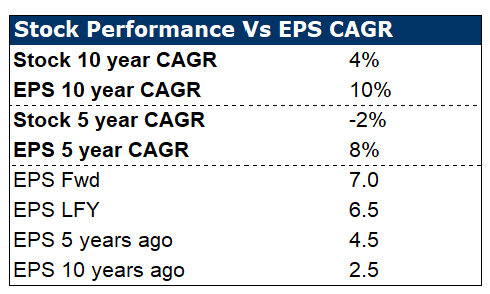

If we take a step back and look at the last 5 years, the stock hasn’t done much at all.

It’s lagged its earnings growth both in the last 5 years and the last decade.

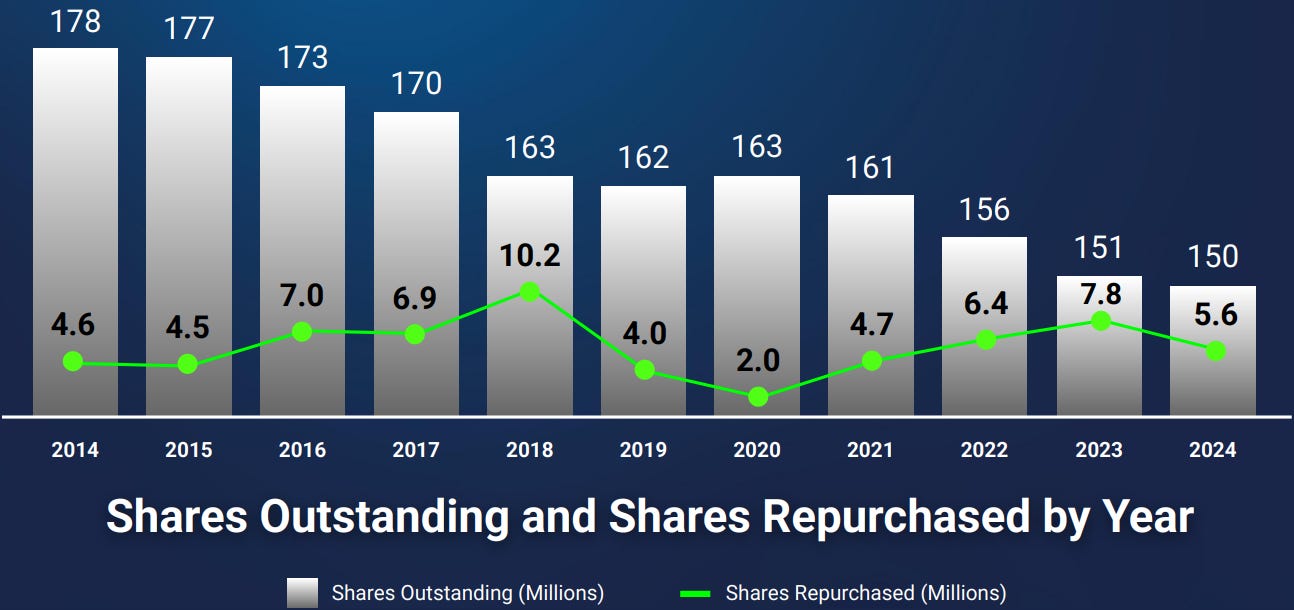

Buybacks, though, have been consistent with the share count down -16% over 2014-2024. In 2025, they bought back c. $800m worth of shares, leaving 143.9 million outstanding. There is $1.2 billion left in their program, which at current prices implies another 13-14 million shares.

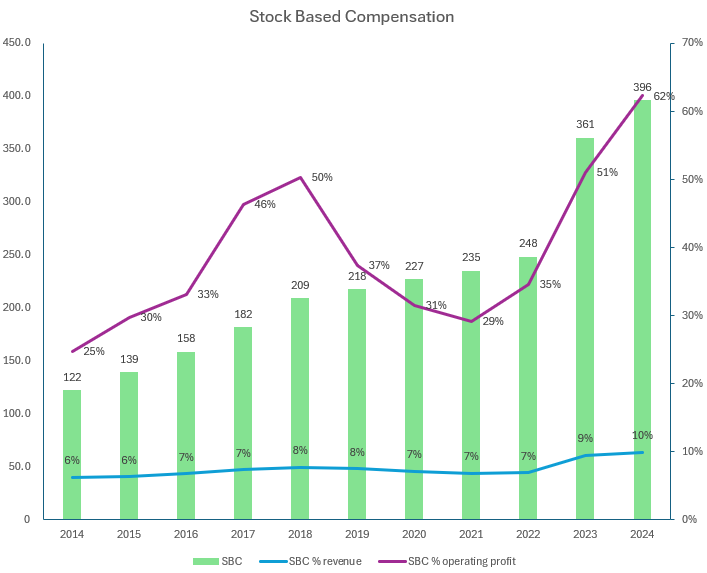

What I don’t like, though, is the large and rising stock-based compensation that amounted to 10% of revenues and 62% of operating profits in 2024. So if you look at the cash flow statement, you’ll see cash from operations of $1.5 billion, but that’s after adding back the SBC. The same goes for consensus estimates. You see a jump in consensus EBIT versus FY24 because analysts are adding back SBC. I don’t agree with this approach because I believe it’s a real cost.

One could argue that this doesn’t matter if the company reaches its goal of 10%+ revenue growth and 30%+ non-GAAP operating margin. Note that based on the company definition, this was 29.2% in FY24 (page 39, AR24). If we use the company definition but remove SBC, then the non-GAAP operating margin for FY24 drops to 19.4%. Regardless, the strong outlook could justify a high price. The company’s products are a necessity for today’s world, and despite the competition, this isn’t a one-winner-takes-all (it’s a multi-cloud world).

Peers

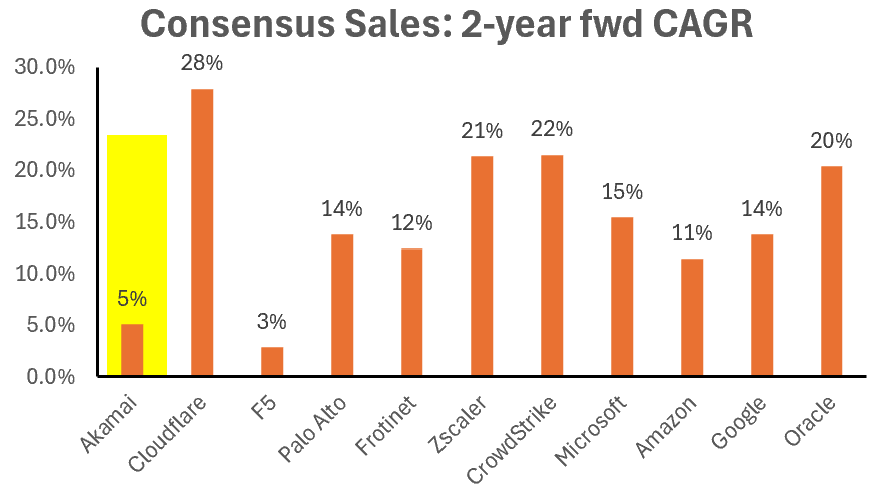

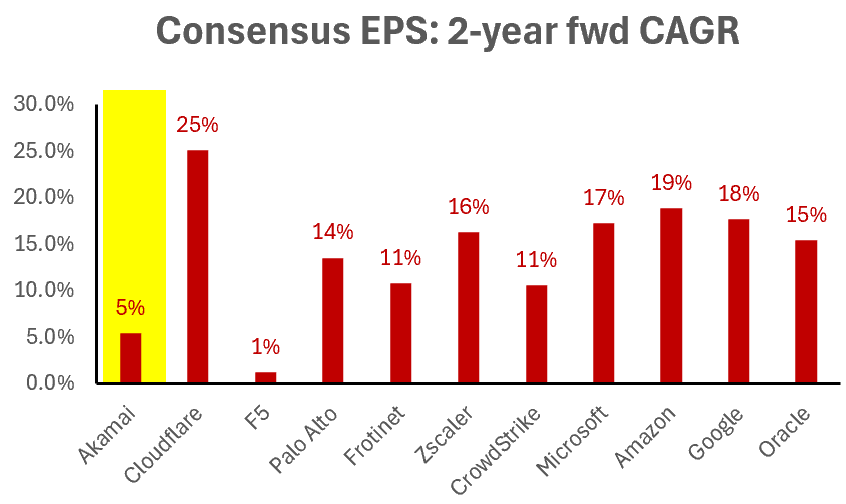

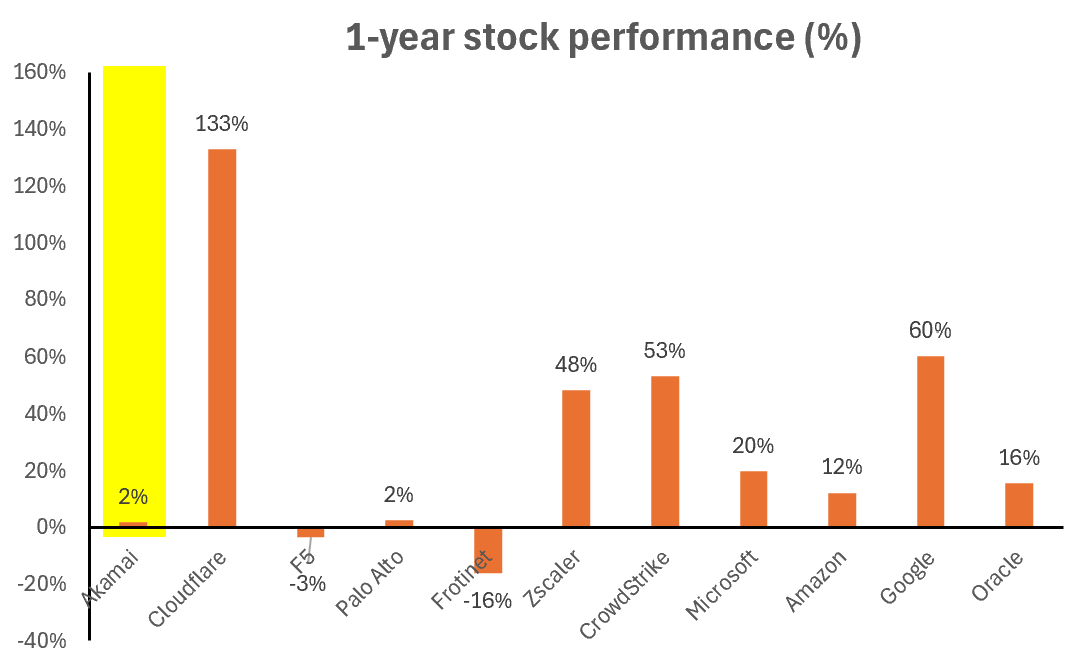

I put together this group of competitors who operate in one or more of Akamai’s segments.

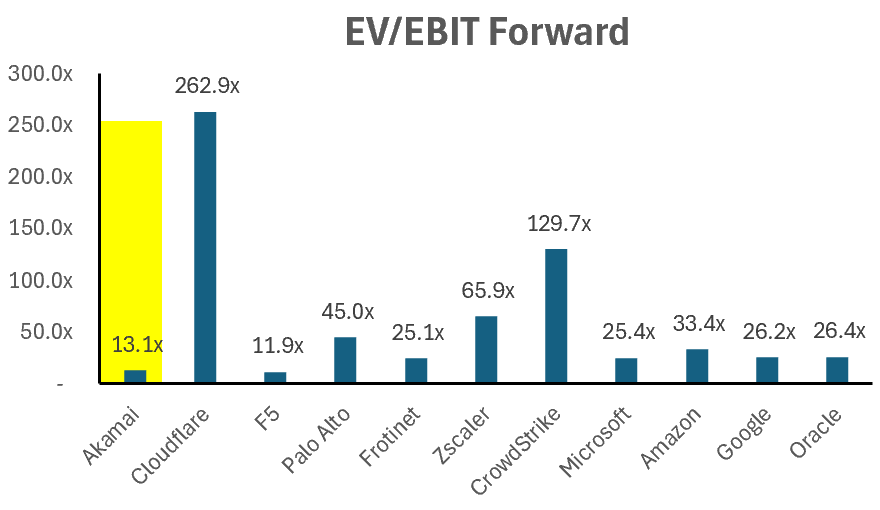

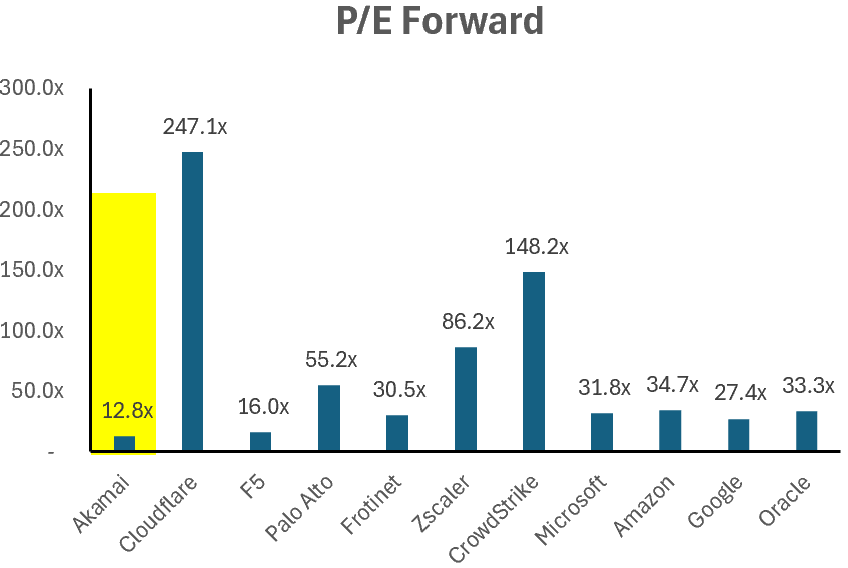

Akamai and F5 are the cheapest in this group

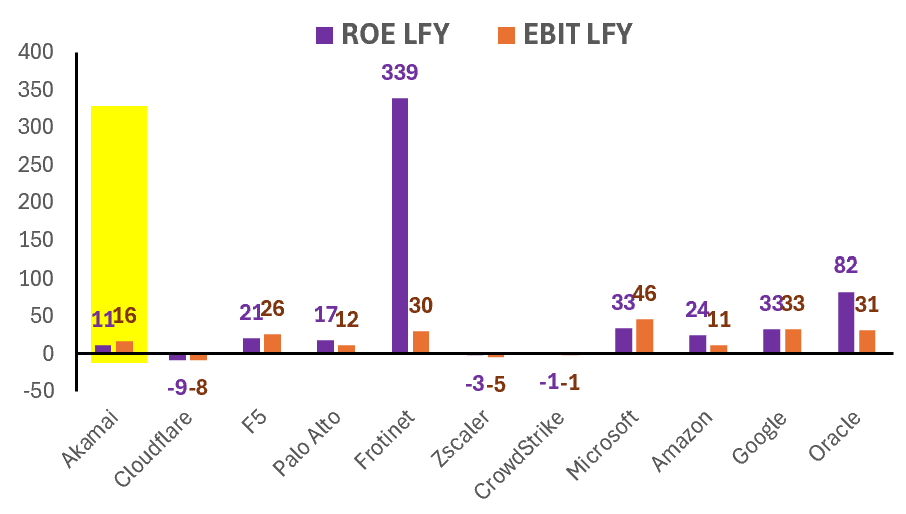

ROE and EBIT margin for Akamai sit in the middle of the pack

But analysts expect the company to grow both Sales and EPS at a slower pace than competitors.

This has translated into lower performance so far over the past twelve months.

I also did a rough DCF, which I won’t include this time, but if management plans work out, then I can see more upside. So I’m definitely looking forward to my chat with Steve because this looks like a relatively cheaper play on security and cloud. Come back in a few days to hear what the market could be missing!

If you want to hear 12 professionals like Steve pitch their best ideas live, then check out my 2-day event: https://fatalphavalue.com/online

Disclaimer: Not investment advice. Do your own work! This substack is not operated by a broker, a dealer, a registered investment adviser, or a regulated entity. Under no circumstances does any information posted represent a recommendation to buy or sell a security. In no event shall the author be liable to anyone reading this post for any damages of any kind arising out of the use of any content available in this post. Past performance is a poor indicator of future performance. All the information on this substack and any related materials is not intended to be, nor does it constitute investment advice or a recommendation. All materials and information you obtain here are exclusively for informational purposes and do not constitute an offer or solicitation to provide any investment services to investors based in the U.S. or elsewhere.