Somero is probably one of the best companies you’ve never heard of. The company pioneered the Laser Screed machine market in 1986.

Basically, it makes machines that make concrete floors flat. The target customer is the commercial concrete flooring contractor. Its equipment has been used in construction products for Amazon, Walmart, IKEA, Coca-Cola, Burj Dubai Mall, etc. It’s a U.S. company with a London listing (2006). It’s in a niche market where the company believes it is the market leader. Recently, their CEO and Chairman retired due to age (Chair was 90!), but several veterans are still around. Check out their 1-minute promo below on YouTube.

Market Info

Ticker: AIM:SOM

Stock Price (Local): £2.27

52-W High (May-21-2024): £3.76

52-W Low (April-24-2025): £1.90

5 Year Beta: 0.62

Avg Volume (3-month, millions): 0.2

Avg Volume (USD, millions): $0.7

Shares outstanding (basic, millions): 55

Country of Incorporation: United States

Trading Currency: GBP

Filing Currency: USD

Enterprise Value

(Figures from left to right are in millions in USD and GBP, respectively)

Market Cap (millions): $172 | £126

Plus: Total Debt $3| £2 of which Leases $3 | £2

Less: Cash and ST Investments -29 | -24

EV (millions): $145| £104

Key Valuation Metrics

P/E forward: 9x

EV/EBITDA forward: 5.0x

Dividend Yield: 6.7%

Key Persons

CEO & Director: Averkamp, Timothy

CFO, Secretary & Director: LiCausi, Vincenzo

Exec VP of Sales and Executive Director: Hohmann, Howard

Board of Directors, Chairman: Scheuer, Robert

Top Shareholders

Kelly, Brian 8% (Note he crossed 3% on Feb 27, 2025 and further increased on Mar 13 and Apr 29)

Vanasek, James T. 7%

Regent Gas Holdings 7%

TrinityBridge Limited 7%

Chelverton Asset Management Limited 7%

Canaccord Genuity Asset Management Limited 6%

Aberdeen Group Plc 6%

Unicorn Asset Management Ltd. 5%

Stock Performance

As you see below, the stock practically tripled in 2021-22, from 200p to 600p. It’s come back as revenue growth dropped from +51% in FY21 to 0%, -10%, -10% respectively in the last 3 years.

FY2021 was a big year for Somero because not only did they have a record number of units sold, but also a record unit sales of their most expensive screeds. You can see this in the sales per unit growth and the units growth below (note the years are from right to left)

Long-term, the stock has roughly grown in line with EPS, but that’s not considering the dividend yield. Including dividends, an investor compounded at 12% over the last decade, despite the decline!

The dividend policy is 50% of adjusted net income plus 50% of excess cash over $25m. The current dividend yield is 7%.

Competition

The company doesn’t have any well-known competitors. The competitors I had found were mostly some Asian companies like Shandon Hiking, and Jamshedji, along with cheap alternatives that can be found on websites like Alibaba. These smaller competitors can’t compete with Somero’s offering. Somero offers 24/7 customer support. Clients are dealing with concrete. They can’t wait until tomorrow. As part of the selling price, training is included. Somero flies people out to the US and hosts them during the included free train. This cost, though, will turn into a benefit and an additional advantage as Somero has introduced a virtual reality simulator (META Goggles) as well as a phone app with instructional videos and info. Somero saves on cost while clients save on time.

For the peer group, I’ve included some charts below on international construction equipment companies. (Data from Capital IQ).

Somero is cheaper on a P/E and EV/EBITDA basis.

I’ve only included 1-year consensus forward charts because there are no projections for sales or EPS 2 years out. The group growth looks flat at best.

Strong ROE and EBIT margin for Somero.

Evidence of a well-run company is the consistently high ROE historically:

Historical multiple

Enterprise Value to the last twelve months EBIT is shown below. The company is currently at around 5.4x. Historically c. 5x has not been a bad entry point.

Forecasts and DCF Valuation

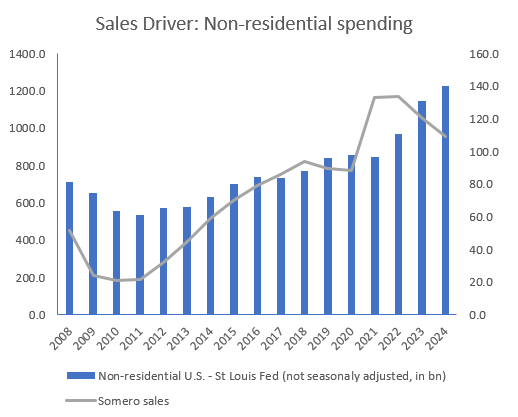

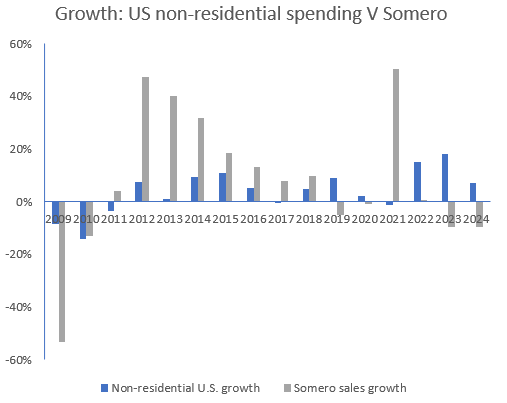

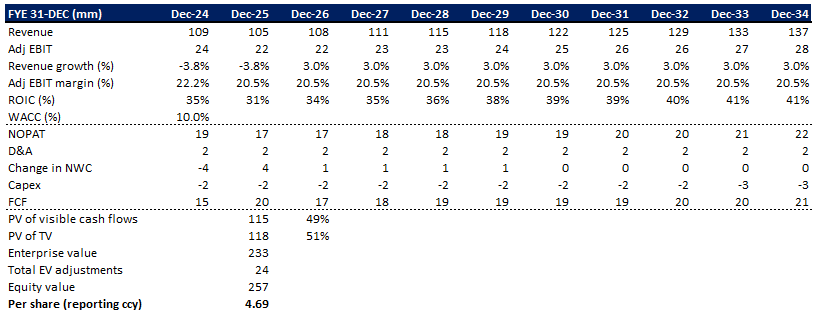

Consensus looks optimistic, or just hasn’t been revised recently, so I’m not using it. (Note reporting is in USD while shares are in GBP). Somero management guided $105m ($109m in 2024, prior guidance $113.6m). So I used $105m and grew that at 3% going forward. Non-residential construction spending in the U.S. is the best statistic to follow per the company, but not the most reliable due to the niche market Somero serves. Over the past 10 years and 20 years, the growth of non-residential spending has been c. 5% and c. 7% respectively (vs c. 5% and c. 6% for Somero). So 3% makes sense to me.

EBITDA was guided at $24 (prior guidance $28.6m). I work off of that number which implies a 20.5% EBIT margin. I keep that constant. Historically, that’s at the low end (see chart below), but I prefer to be conservative with such a cyclical business.

Depreciation and CAPEX are a wash. Below are my summary forecasts.

My DCF results in an intrinsic value of $4.69 or £3.53, compared to the current market price of around £2.27, representing significant upside. That valuation implies an EV/LTM EBIT of 9.6x, a valuation that it has traded at in the past (see the chart in this article).

Even if I assume that sales growth is a repeat of 2008-17 period, then I estimate that a similar 10-year cycle would imply an average EBIT of $16m (or £12m). That translates to around 11% FCF/EV. I’m not a big fan of cyclical companies. But Somero is quality at a reasonable price with a product and service that is needed and won’t go extinct any time soon. So I will consider a starter position for my personal portfolio, keeping in mind that the stock may go lower. My biggest concern is that the stock drops, the company gets acquired, and I don’t realize value. What do you think?

Enjoyed this analysis? Get more Exclusive Investor Insights like this to help you Stay Ahead. Subscribe below now – it's Free.

Disclaimer: Not investment advice. Do your own work! This account is not operated by a broker, a dealer, a registered investment adviser, or a regulated entity. Under no circumstances does any information posted represent a recommendation to buy or sell a security. In no event shall the author be liable to anyone reading this post for any damages of any kind arising out of the use of any content available in this post. Past performance is a poor indicator of future performance. All the information on this substack and any related materials is not intended to be, nor does it constitute investment advice or a recommendation. All materials and information you obtain here are exclusively for informational purposes and do not constitute an offer or solicitation to provide any investment services to investors based in the U.S. or elsewhere.

Glad you like it. First noticed it in 2022 when I was working for a fund. Showed it to a few of the guys. Looked like a cool little company but didn’t do anything. Was a good call to hold off. New large holder Kelly is an interesting development. 2 pounds makes sense though a long may have to average down if we go into recession.

I've had this one on the watchlist for a while. Appreciate your write up!