An ex-colleague of mine from Veraison Capital sent me a link to an interview that Steven Wood gave to The Market on Swatch Group. Steven believes the company can do much better and that its current stock price is cheap. So cheap that it’s his largest position. He wants to help the company and has nominated himself for the board. I met Steven in New York some years ago, and we have run into each other a few times. As I am a Greek male losing my hair, I’m pretty jealous of Steven. On a more serious note, I like his work, and so I thought it was time to take a look at the company. In full disclosure, he has no idea I am writing this article, but I may reach out to him post publication.

Market Info

Ticker: SWX:UHR

Stock Price (Local): CHF 142.15

52-W High (May-17-2024): CHF 201.90

52-W Low (April-07-2025): CHF 120.30

5 Year Beta: 0.81

Avg Volume (3-month, millions): 0.2

Avg Volume (USD, millions): $40.0

Shares outstanding (basic): 52

Country of Incorporation: Switzerland

Trading Currency CHF

Filing Currency CHF

Enterprise Value

(Figures from left to right are in USD and CHF)

Market Cap (millions): $8,934 | CHF 7,378

Plus: Total Debt $24 | 22 of which Leases 0 | 0

Plus: Minority Interest $116 | CHF 105

Less: Cash and ST Investments -$1,541 | CHF -1,396

EV (millions): $7,533 | CHF 6,109

Key Valuation Metrics

P/E forward 24x

EV/EBITDA forward 7.3x

Dividend Yield 3.2%

Key Persons

President of Exec Group Mgmt Board, CEO & Director: Hayek, Georges

Member of Exec Group Mgmt Board & Director: Hayek, Marc

CFO & Member of Exec Group Mgmt Board: Kenel, Thierry

Board of Directors, Chairman: Hayek, Nayla

Top 5 Institutional Holders

Brandes Inv Partners: 9%

UBS Asset Mgmt: 6%

Vanguard: 3%

Norges Bank Inv Mgmt: 2%

Schroder Inv Mgmt: 1%

The Hayek family controls c. 43% of the voting rights, so if you are a small shareholder, then you have to like how management runs things. Proxy advisory firms such as Institutional Shareholder Services (ISS) and Glass Lewis have recommended that shareholders don’t re-elect the Chair and the CEO (both Hayeks). ISS is concerned with the lack of independence and the long presence of the family members. Bernstein analyst Luca Solca had the following to say: "With no financial calendar, no IR function, no functional market communication we think this stock is borderline uninvestable". This negative view of Swatch’s management is shared by most investors. As I read the CEO’s bio here I’m somewhat concerned about the emphasis on Nick Hayek’s film industry details. While impressive, it sends the wrong message.

Stock Performance

The stock has declined significantly since its twin peaks at c. 330. 56% of revenue came from Asia (33% from China) in 2023. A -30% drop in revenue from China in 2024 hurt the stock. To make matters worse, the company maintained its production capacity and avoided redundancy. So with personnel expenses flat, the operating margin took a hit.

EPS growth has been even worse than the stock! -17% CAGR over 10 years and -23% CAGR over the last 5 years.

Investors who have owned the stock for the last 2 decades have made nothing! Shocking for such a well-known company. The stock has been pitched by many value investors in the past, but it looks like they fell into a trap.

Comparison: Multiples, Returns, Growth

Publicly listed competitors (or owners of competitive brands) include Citizen, Seiko, Titan, Movado, Casio, LVMH, Movado, and Richemont. The company competes with other brands as well, such as Rolex, but they are not publicly listed.

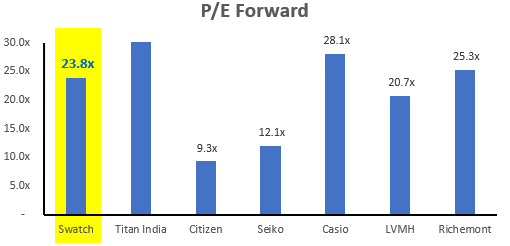

From a P/E perspective, the company looks expensive, especially considering that luxury behemoth LVMH is trading at c. 20x. Two years out it’s c. 16x. (FYI, Titan is off the charts). EV/EBITDA is at a reasonable 7x multiple.

Low forward growth in top line is expected, however, analysts forecast a boost in earnings due to an improvement in margin.

Operating margin and ROE don’t compare well to luxury but are similar to the lower end.

ROE has historically been in the mid-single digits…

Forecasts and DCF Valuation

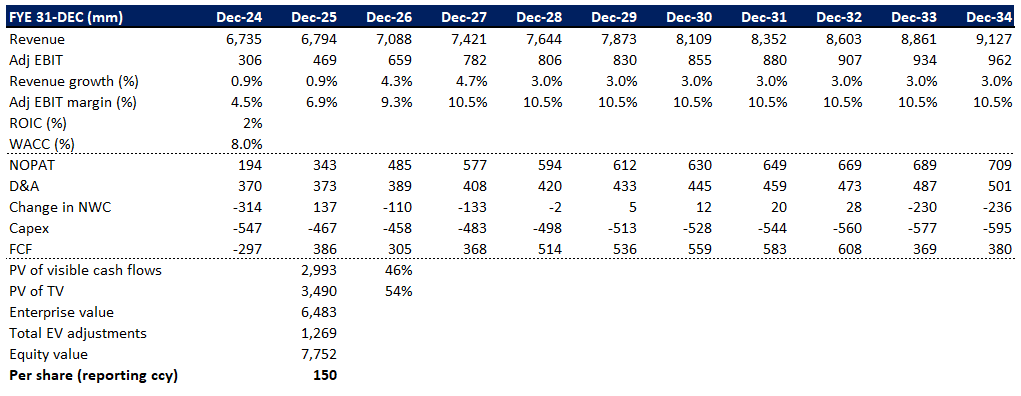

Consensus estimates for revenue growth are 0.9%, 4.3%, and 4.7%, respectively, for the next 3 years. I assumed 3% after that. This compares to a -2.5% CAGR for the last decade. Revenue essentially dropped from CHF 8.7 billion in 2014 to CHF 6.7 billion in 2024.

Operating margin also dropped significantly (from 20% to 5%) despite the rise in gross profit (from 79% to 83%). Analysts expect the operating margin to recover to 11% by 2027, and it has been kept constant at that rate for this DCF model.

It’s hard to get excited if we look at EPS, which was CHF 16.76 in FY2023, and only recovers to CHF c. 14, 10 years out, based on the above assumptions.

This results in an intrinsic value of CHF 150, which is above the current market price of the stock.

FYI, FCF was around 800m in 2019. That translates to around 12% of today’s EV.

What if the company were able to return to a 14.6% EBIT margin by 2028? 14.6% was the average EBIT margin from 2014-24, excluding 2024 and 2020 (COVID). Then, all else equal, the intrinsic value rises to CHF 209. The high-end segment is growing faster and is probably significantly more profitable. In the interview, Steven Wood points out that this is what the company should focus on. I agree.

Hidden asset

The company has no debt and owns a significant portfolio of properties. The historical cost of its land and buildings is around CHF 3 billion. Under Swiss accounting rules, the property, plant, and equipment are not revalued, so these assets are probably worth a lot more. Based on Price to Tangible Book Value, the valuation is at an all-time low, and that is based on historical numbers! The properties are in impressive locations. My ex-colleagues in Zurich constantly pointed out buildings that belong to Swatch!

Final Thoughts

The shares look cheap. Steven makes a good case and has some good ideas for the company. The question is, will management listen? They have responded that he isn’t Swiss and doesn’t have a Swiss industrial background. Well, he wasn’t Portuguese or had a logistics background either when he got involved with CTT, but since he got a board seat, shareholder return was impressive. So I find Swatch’s response disappointing. But the vote isn’t until May 21, so perhaps they will change their mind. I think if management becomes open to change and listens to other people’s views, then a lot of investors will come back into the stock. For now, I’m on the sidelines. What do you think?

Disclaimer: Not investment advice. Do your own work! This account is not operated by a broker, a dealer, a registered investment adviser, or a regulated entity. Under no circumstances does any information posted represent a recommendation to buy or sell a security. In no event shall the author be liable to anyone reading this post for any damages of any kind arising out of the use of any content available in this post. Past performance is a poor indicator of future performance. All the information on this substack and any related materials is not intended to be, nor does it constitute investment advice or a recommendation. All materials and information you obtain here are exclusively for informational purposes and do not constitute an offer or solicitation to provide any investment services to investors based in the U.S. or elsewhere.

This management team is not for turning. The realistic best case outcome for minorities here appears to be a take private. The issue is the Hayek's don't have the cash. While they could arrange financing in theory, Hayek abhors leverage (given Swatch's own founding story as a consolidator of a blown up Swiss watch industry). Therefore we are at an impasse. The underlying business is in the wrong post code: tier 2 brands, mass market overexposure, China/Asia overexposure. There might be times when these are the areas to be in but they haven't been recently and likely won't be for a while. In the meantime they will continue to burn cash producing watches market does not need and accumulating inventory. It's staggering that book value of inventory is now larger than the enterprise value of this company. Every dog has its day. Downside in this one is probably limited given all of the above but it's a weird story to buy