Crocs: When Pessimism Creates Opportunity

Crocs’ stock is a case where all the focus is on the negative while completely ignoring any positives. People appear to forget the company isn’t selling Office 365 licenses but is a retail company selling footwear. But it’s not just any retail company…

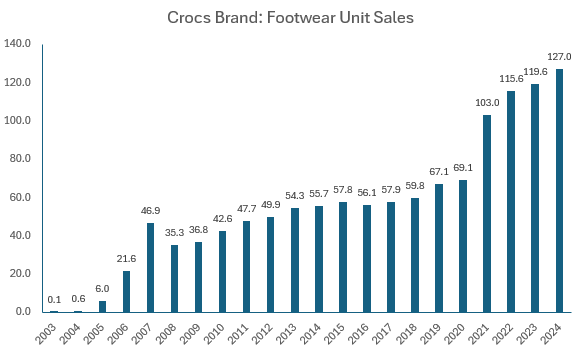

Consistently growing volume…

Crocs have only experienced 2 years of negative volume growth! Volume only fell in 2008 (Global Financial Crisis) by -25% and in 2016 -3%. So only 2 bad years out of 21. And while there was a positive bump during COVID, volume has continued to grow. I expect c. 130m pairs of Crocs to be sold in 2025.

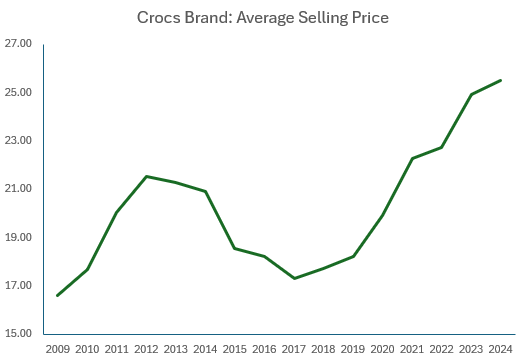

… while achieving a higher average selling price

The average selling price per unit was $16.60 in 2009. Over the next 15 years, this has grown to $25.52 for a 2.9% CAGR. During the same period, volume grew at an 8.6% CAGR.

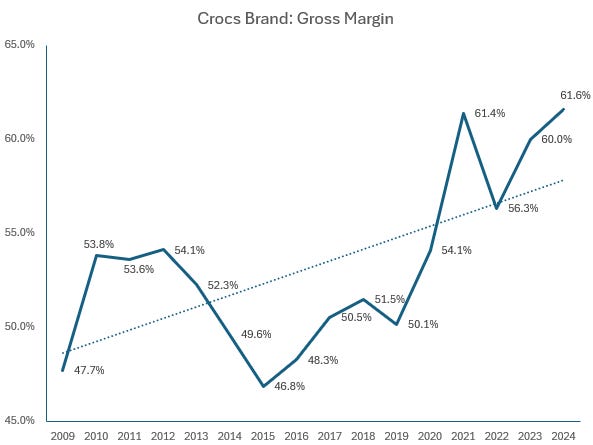

… which resulted in a higher gross margin

The Crocs brand gross margin rose from 47.7% in 2009 to 61.6% in 2024!

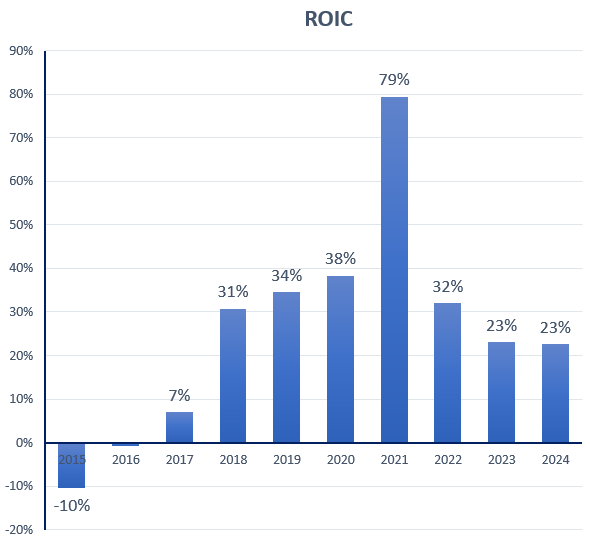

…impressive return on invested capital

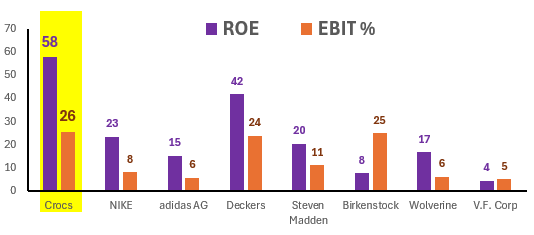

Return on equity was 58% while ROIC has consistently been at double digits. Further proof of value creation and the existence of a moat.

Brand and company recognition

The company has won multiple awards, including being listed among “Best Mid-Size Companies” (Time), “Most Trustworthy Companies in America” (Newsweek), and “America’s Best Employers for Women” (Forbes).

The brand appeared in the NY Museum of Modern Art (below), in an exhibit that focused on objects that reshaped consumer behaviors & societal norms from the mid-20th century onwards (e.g. Sony Walkman, Post-It Note, Macintosh, etc)

In March, I was in Thailand for the in-person idea exchange I organised (see here for video - scroll down), and I saw Crocs everywhere. Sure, there were a lot of fakes. But I believe the existence of fakes is further evidence of the brand’s strength.

Let’s not forget the fashion shows such as Paris (2017) and London (2016). Here is an $850 pair:

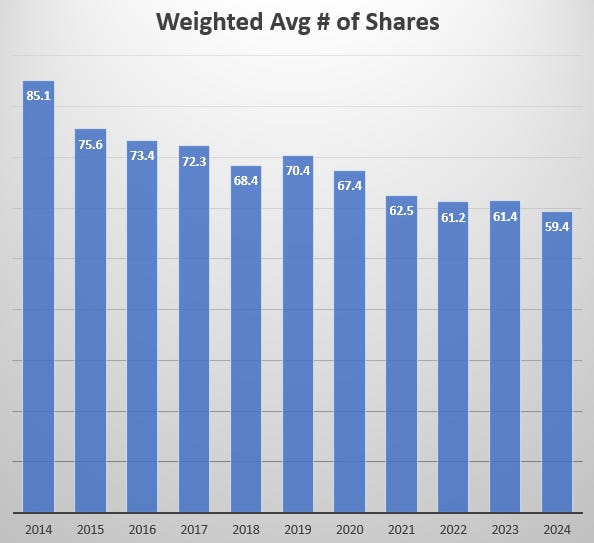

Big brand, big profits, big buybacks!

The company has consistently repurchased shares, thus reducing shares by over 30% in the last decade! There are currently under 52 million shares outstanding, while the company has a c. $900m outstanding program in place. At current prices, that translates to 11+ million shares or 20% + of share count!

FYI, I’m organising a 2-day online event where 12 professional investors will pitch stock ideas live! Ask questions and join our WhatsApp Chat. Starting at 99 euros, check it out by clicking the button below.

Now onto some negatives…

Hey Dude: A mistake or a catalyst?

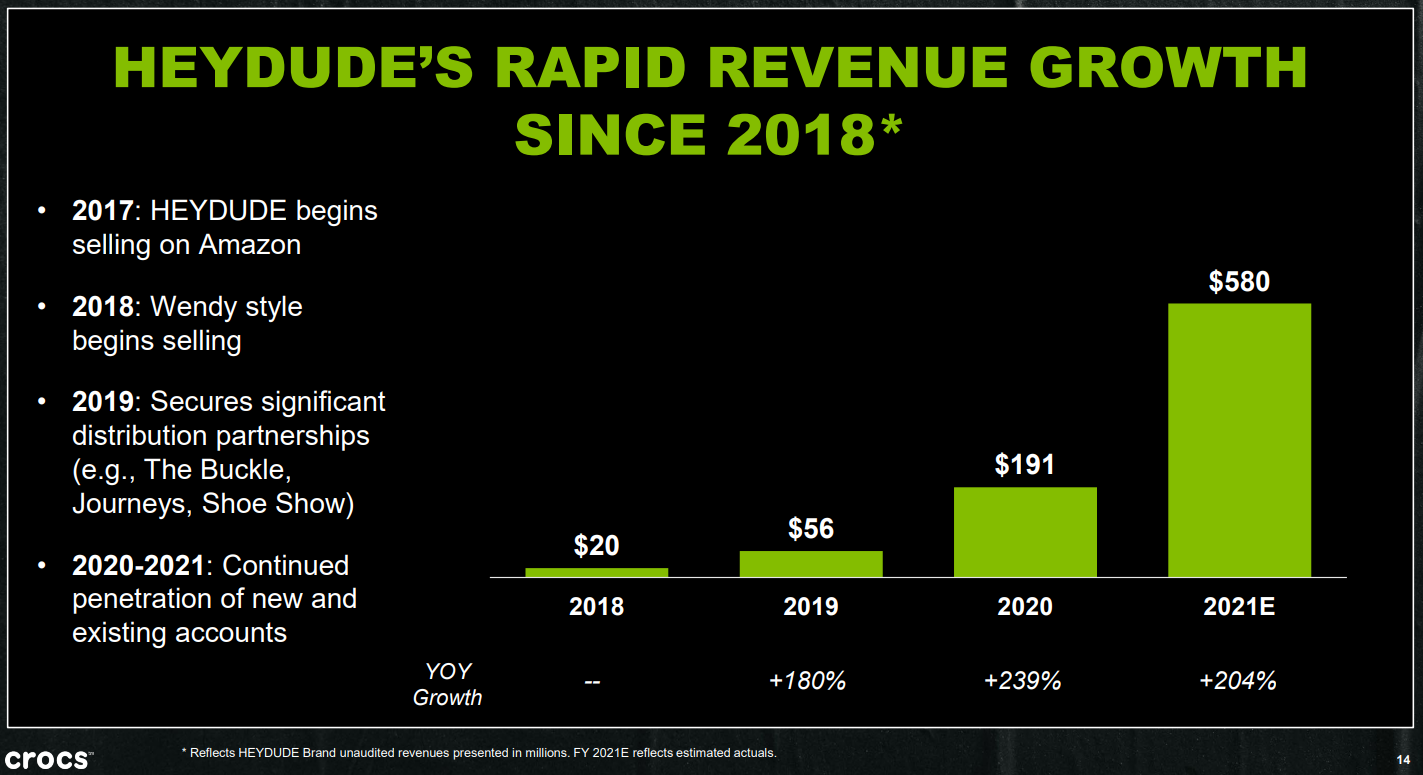

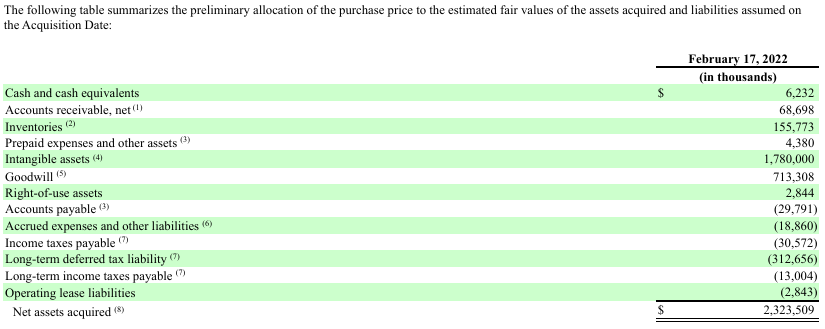

Crocs bought the Hey Dude brand for $2.3 billion. The acquisition was completed on February 17, 2022. The company paid 4x revenues. Considering the triple-digit growth rates, there was probably a little too much excitement surrounding the name. The market didn’t like the acquisition, and the stock dropped c. -12% when it was announced. Piper Sanders called it “one of the fastest rising brands”, and others liked the diversification aspect it brought to the company.

In Crocs’ 2022 10-K, we see that Hey Dude had $852m in revenues and $211m in operating income before corporate costs. (Note the incomplete year, as it was for the period starting February 17 and ending year-end.) The company’s corporate costs increased by $34.3m in that year. If we assume the entire increase was due to Hey Dude, then EBIT comes out to $177m. That’s a 21% margin. If we assume that margin on 2021 revenue of $570m, then Crocs was paying around c. 20x EV/EBIT. As the table below shows, there was little debt, so it was c. 20x P/EBIT as well ($2300 / (570 x 0.21).

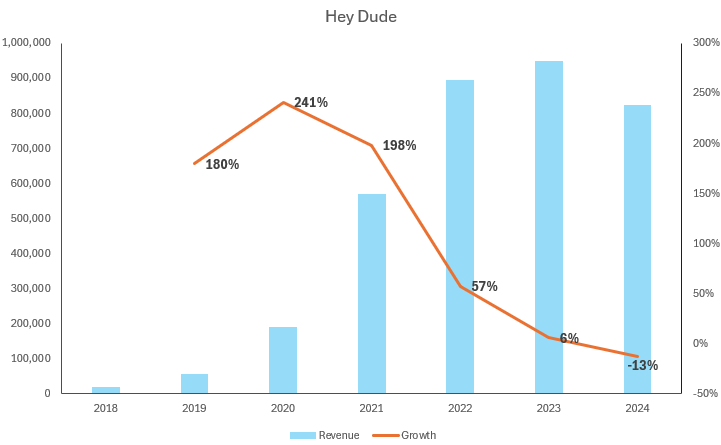

If revenue continued to grow at the high rate, then it would have been called a genius move. Revenue growth deflated very quickly, and management's aggressive efforts turned out problematic.

Can Terence Reilly save the day?

Terence was the chief marketing officer of Crocs until 2020 and contributed significantly to the clogs brand building. He left Crocs and took on the role of president of Stanley (the ridiculously large and now popular cups). At Stanley, he increased sales from $70 in 2019 to $750m in 2023. He is now back at Crocs. Initially as President of Hey Dude, and now as Chief Brand Officer. So can lightning strike three times? We hope so!

“At Crocs we had a relevance problem, and we changed that, and Stanley had an awareness opportunity,” HeyDude, he said, needs help with both. (Terence Reily, WSJ)

Hey Dude is a much smaller U.S. brand. A lot of people outside the U.S. don’t know it. I certainly can’t find any to try here in Cyprus. To me, that smells like opportunity. Some friends in the U.S. have told me that they found the shoes pretty comfortable and were happy with them. So if Terence can grow the brand and take it international, then the brand could be a catalyst for the stock

“I don’t like to lose in anything. I turn the Peloton on in the morning, and I turn the instructors off. I just look at the leaderboard of who I’m going to beat.” (Terence Reily, WSJ)

I certainly like this guy’s attitude!

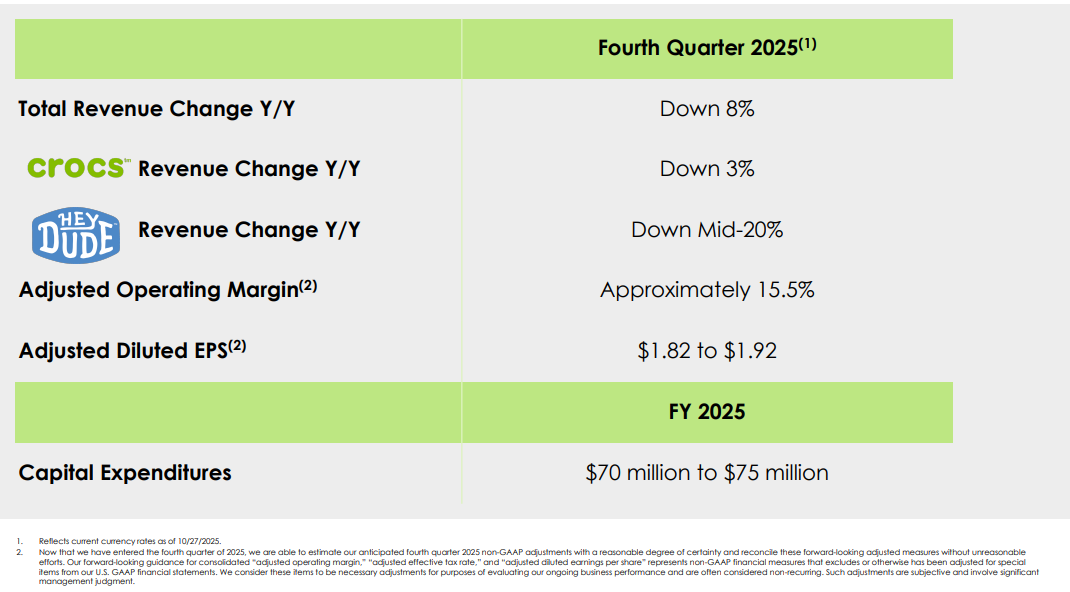

Outlook

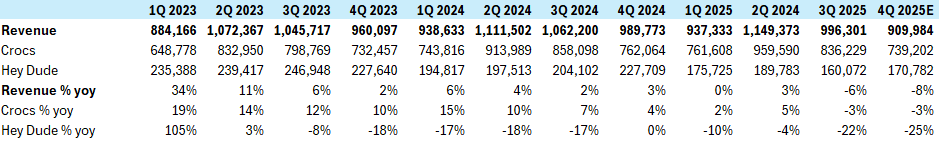

Third quarter revenue dropped -6% and the outlook the company gave for the fourth quarter was -8%. We have no other info going forward, but I think that’s also the nature of the sector with its ups and downs.

In Q4, I estimate flat pricing for Hey Dude, and c. -1% for Crocs. For volume, I have -25% for Hey Dude and -2% for Crocs. These estimates are based on the trend in pricing in volume. The company no longer reports pricing and volume in the 10-Qs like they used to, but there is management commentary around these, which can be used to come up with a best estimate.

If I look at the last three years, then my estimates imply an upward trend in the average selling price.

And while the company has been able to increase pricing on Hey Dude, the volume declines have been hard to swallow, with double-digit declines in 6 of the last 8 quarters. But perhaps it’s not so bad? If we assume that the COVID boost Hey Dude got wasn’t sustainable long-term, then the decline to a more normal rate makes sense. I have penciled in 22.5m pairs for 2025 for Hey Dude. That would imply a 4% CAGR from 2021 and a 29% CAGR from 2020. That compares to Crocs Brand 6% from 2021 and 14% from 2020, however, Crocs Brand has significantly higher volume (in 2020: 69m vs 6m for Hey Dude).

So my takeaway is that Hey Dude volume is either normalizing, and I’m ok with that, or it’s just not a great brand. If it’s a case of the 2nd, then Crocs management should consider selling it. But let’s also not forget Mr. Reilly, who may work his magic and turn Hey Dude into a huge success! I think it’s too early to tell as Mr. Reilly needs a little more time.

Peers

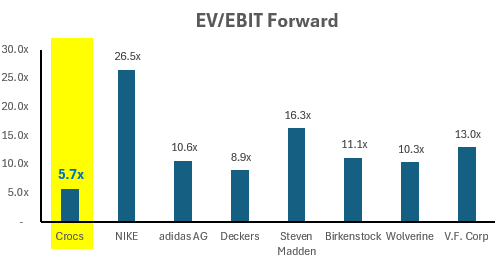

Historically, Crocs has had fantastic returns on capital and very high margins compared to its competition.

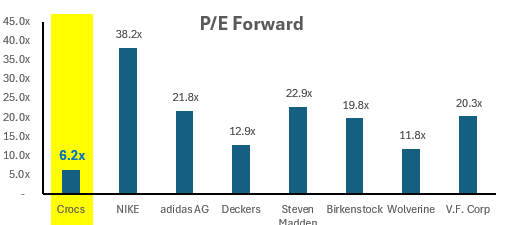

But it’s now trading at the lowest multiple.

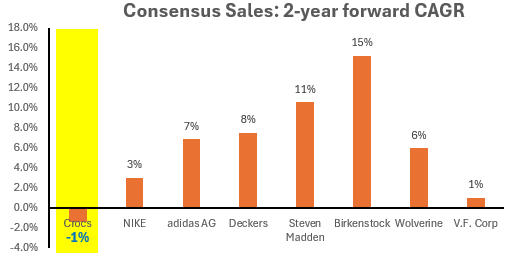

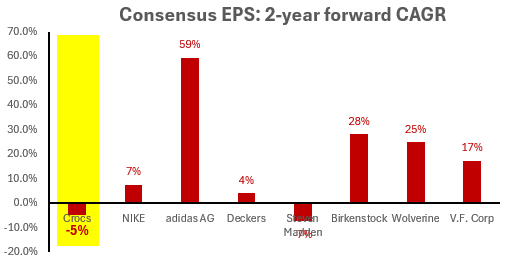

And this is because of growth. Consensus has the company's sales and EPS declining.

Market Assuming The Worst!

The market doesn’t believe in the company and assumes the worst. At the moment, the consensus estimate for free cash flow is $618m. I have c. $600 for 2025. That’s compared to $900m+ in 2024! But even at $600m the FCF to EV is 11%. That’s way too cheap for this company, in my opinion. Now let’s assume Crocs just continues generating $600 FOREVER, which means ZERO price increases and ZERO volume growth until the end of time, regardless of inflation. Let’s put an 11% WACC. Only then do we get an intrinsic value of $75, which is where the stock is today.

But what if…

We assume a 3% growth rate and a 9% WACC? Then the intrinsic value rises to $169.

Valuation matters

And I believe this is a case of heads I win, tails I don’t lose. We have a great valuation and a great brand. The brand would have to have serious issues for shareholders to face a permanent loss of capital. Personally, I believe the probabilities are in my favour and I own the stock.

For 2 days of stock ideas from a dozen investors, check out https://fatalphavalue.com/online

Disclaimer: Not investment advice. Do your own work! This substack is not operated by a broker, a dealer, a registered investment adviser, or a regulated entity. Under no circumstances does any information posted represent a recommendation to buy or sell a security. In no event shall the author be liable to anyone reading this post for any damages of any kind arising out of the use of any content available in this post. Past performance is a poor indicator of future performance. All the information on this substack and any related materials is not intended to be, nor does it constitute investment advice or a recommendation. All materials and information you obtain here are exclusively for informational purposes and do not constitute an offer or solicitation to provide any investment services to investors based in the U.S. or elsewhere.