I have no idea what beer Warren Buffett drinks, or if he even drinks beer, but Berkshire Hathaway did purchase shares in Constellation Brands ($STZ) in Q4 of 2024. Did the oracle or one of his generals overpay? (We don’t know who actually put this investment on, and it’s only a c0.5% position). Still, it’s interesting to take a look as Berkshire is now a top 10 holder!

c80% of the company’s sales is beer. STZ owns the exclusive U.S. rights to Corona and Modelo through a perpetual brand license acquired in 2013 as part of a $4.8 billion deal with AB InBev.

Market Info

Ticker: STZ

Stock Price (Local): $170.96

52-W High (April 11, 2024): $274.87

52-W Low (February 12, 2025): $160.46

5-Year Beta: 0.79

Avg Volume (3-month, millions): 2.9

Avg Volume (USD, millions): $497.4

Shares outstanding (basic): 181

Enterprise Value

Market Cap (USD, millions): $30,893

Plus: Total Debt $12,120, of which Leases $696

Plus: Minority Interest $254

Less: Cash and ST Investments -$74

EV (USD, millions) $43,193

Key Valuation Metrics

P/E forward: 13x

EV/EBITDA forward: 11.0x

Dividend Yield: 2.4%

Key Persons

President, CEO & Director: Newlands, William

Executive VP & CFO: Hankinson, Garth

Executive VP, Chief Legal Officer & Secretary: Bourdeau, James

Board of Directors, Chairman: Baldwin, Christopher

Top Holders

Vanguard: 10%

Capital: Research and Mgmt 9%

BlackRock: 6%

State Street: 4%

RSS Business Holdings: 3%

Berkshire Hathaway: 3%

Insiders above 1%

Bennett, Abigail J: 2%

Performance

Over the last 5 and 10 years, the stock has grown at a rate below historical EPS. While the 10 year CAGR in EPS was 14%, the stock only rose 4%. Growth slowed in the last 5 years to a 5% CAGR with the stock practically flat.

Forecasts and DCF Valuation

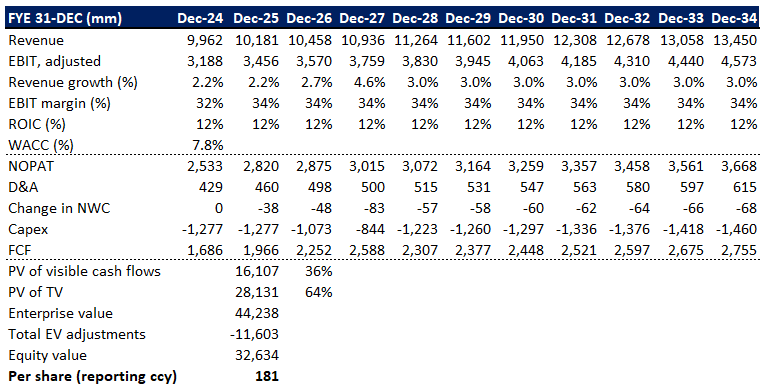

I took consensus estimates for revenue and operating profit for the next 3 years. Beyond that, I assumed a 3% growth (versus 4% CAGR the last 5 years) and a 34% operating margin (in line with historical).

Non-Cash Working Capital is derived from Non-Cash Current Assets and Liabilities as per FY2024. This results in an NCWC that is 17% of sales (vs 23% in the prior decade, but compares to an industry average of 16%). For the industry, you can look at the data provided by NYU professor Damodaran on his website (click here). Net Capex (CAPEX minus depreciation) is 6%, which is also in line with the industry.

This gives me a value of $181. As I’m typing this up, the stock has jumped 5% and is actually back at… $181.

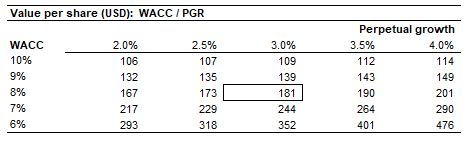

Now, you may not agree with my WACC or my margins. I’ll assume you don’t have a problem with the 3% growth :) So let’s take a look at some sensitivity analysis.

Let’s assume that the WACC goes up by 1%, then the value drops by -c$40.

If the EBITDA margin drops by 2% then the value drops by -$10.

Perhaps the perpetuity growth should be 4% instead of the 3% that I used, well then the value would go up by +$20.

So Berkshire’s purchase at $200+ (look at the chart above) is a little rich to me. But their team probably spent more time than I looking at this, and maybe saw something that I didn’t price in.

Decent company and worthy of taking a look at! Anyone buying now can brag that they got in at a better price than Berkshire :) Let me know what you think in the comments. Subscribe (it’s free) if you find this interesting. Your interest provides me with fuel :)

Disclaimer: Not investment advice. Do your own work! This substack is not operated by a broker, a dealer, a registered investment adviser, or a regulated entity. Under no circumstances does any information posted represent a recommendation to buy or sell a security. In no event shall the author be liable to anyone reading this post for any damages of any kind arising out of the use of any content available in this post. Past performance is a poor indicator of future performance. All the information on this substack and any related materials is not intended to be, nor does it constitute investment advice or a recommendation. All materials and information you obtain here are exclusively for informational purposes and do not constitute an offer or solicitation to provide any investment services to investors based in the U.S. or elsewhere.