Who doesn’t stare at any model of the Italian stallion on the road? (Or to be precise, the prancing horse; ‘Cavallino Rampante’ in Italian). But admiration for a product doesn’t necessarily make it a great investment. As the stock has been recording 52-week lows, I decided it was time to calculate its intrinsic value to see what’s pricing into this legend.

Market Info

Ticker: BIT:RACE (Capital IQ)

Stock Price (Local): €386.20

52-W High (February 18, 2025): €492.80

52-W Low (April 7, 2025): €347.00

5 Year Beta: 0.67

Avg Volume (3-month, millions) 0.5

Avg Volume (USD, millions): $201.4

Shares outstanding (basic): 178

Country of Incorporation: Netherlands

Trading Currency: EUR

Filing Currency: EUR

Enterprise Value

(Figures on the left are in USD, and on the right are in EUR)

Market Cap (millions): $77,804 | €68,483

Plus: Total Debt 3,470 | €3,352 of which Leases 131 | €126

Plus: Minority Interest $10 | €9

Less: Cash and ST Investments -$1,815 | -€1,753

EV (millions): $79,469 | €70,091

Key Valuation Metrics

P/E forward 43x

EV/EBITDA forward 25.3x

Dividend Yield 0.8%

Key Persons

Executive Chairman: Elkann, John

CEO & Executive Director: Vigna, Benedetto

Chief Financial Officer: Piccon, Antonio

Board of Directors, Chairman: Duca, Sergio

Controlling Shareholders

Exor N.V. holds c20% of Ferrari equity but c30% of the voting power. Exor sold c4% of its holding in 2025, hence the reduction versus the annual report. Exor is controlled by Italy’s Agnelli family that holds a c57% stake in the company and c86% of the voting power.

Piero Ferrari (son of founder Enzo Ferrari) owns c11% of the shares and c16% of the voting rights. His stake has remained unchanged since Ferrari’s 2015 IPO.

Top 5 Institutional Holders

Baillie Gifford: 3%

Vanguard: 3%

Capital Research and Mgmt: 2%

Amundi Asset Mgmt: 2%

Jennison Associates: 2%

Stock Performance

The stock is around -22% off its peak, as shown below.

Despite the decline, the stock has performed well, compounding at 22% over the last 5 years. The company listed its shares on the Euronext Milan on January 4, 2016 so there is no 10-year history. The Milan listing was at €43, so until recently it was a 10x for those initial buyers!

Industry Volumes

The chart below is from the annual report. It shows the volume for Ferrari (left scale), Luxury Performance (right scale), and Enlarged Luxury Performance (right scale). Volume is units registered.

Luxury Performance includes “all two-door luxury sports cars with power above 500 hp, and retail price above Euro 180,000 (Italian market price including VAT as reference) sold by Aston Martin, Audi, Bentley, BMW, Ferrari, Ford, Honda/Acura, Lamborghini, Maserati, McLaren, Mercedes Benz, Porsche and Rolls-Royce.”

Enlarged Luxury Performance also includes the high-riding four-door cars (500 hp+, priced Euro 180k+), sold by the same aforementioned competitors, with the addition of Land Rover. The Purosangue is the only Ferrari four-door model.

Ferrari has grown at double the rate of its direct competition in luxury (c5.3% vs c2.6%), but if we include the enlarged group, then it’s been roughly in line (c5.3% vs 4.9%).

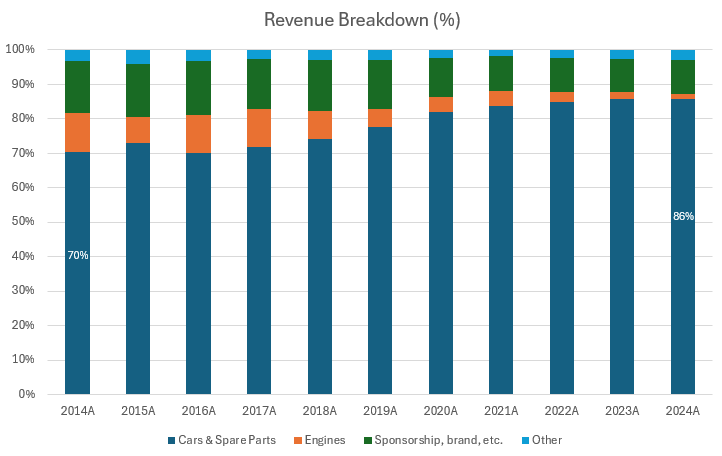

Revenue Breakdown

86% of revenue is from Cars and Spare Parts, which have grown at a c11% CAGR. These revenues also include personalization revenues, which are 20% of this segment.

Engines consist of engines sold to Maserati and rental of engines to other Formula 1 racing teams. Due to the termination of the contract with Maserati, Engines is no longer broken out in the filings. For 2024, I’ve included the 9-month figures given in the quarterlies. In any case, the total segment has been in decline, and its size makes it irrelevant. Sponsorship/brand consists of brand appeal (merchandise, fashion, licensing) and F1 revenues. The segment is c10% of revenues and has grown at a c5% CAGR. Other revenues consist of financial services activities, management of the Mugello racetrack, and from 2024+ what is left from engines. The combined new Other is 4%.

Long story short, car sales have driven total revenue CAGR to c9%.

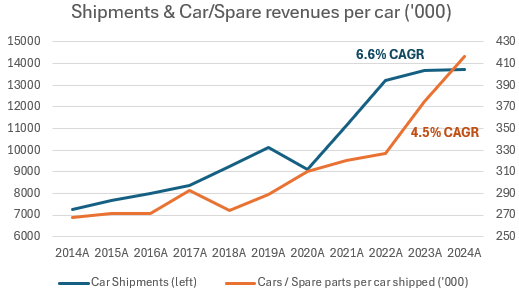

Car shipments (left scale on chart below) have risen at a 6.6% CAGR from 2014. (Worth mentioning that 51% of cars shipped were hybrids!)

If we take revenue from Cars & Spare Parts and divide it by shipments, we get revenue per car of €417k versus €268k in 2014 (c4.5% CAGR). Note that this is a rough analysis, as spare parts should have been removed to get a clean pricing analysis.

Ferrari has a low-volume strategy where it restricts production. Common practice among luxury brands. Assuming flat volume and 11% growth in pricing (similar to 2024), and flat revenues from other segments (not including Maserati), then we get to €7.2, which is also equal to the consensus.

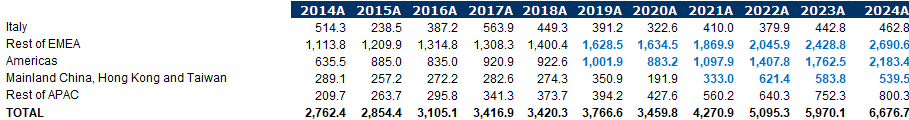

From a geographical perspective, I wanted to look at the 10-year history. The current breakdown in the annual report is different to the historical so I made the necessary adjustments to give us the 10-year history.

Observations:

Italy is flat. -1% CAGR

Rest of EMEA has been growing at a 9% CAGR.

Americas has grown at 13% due to U.S. revenues (not shown) which are now 29% of total vs 23% in 2019. Growth accelerated in the US in the last 3 years as it rose 29%, 28%, and 25%, respectively.

Mainland China, HK, and Taiwan grew at 6% while China revenues (not shown) declined -10% and -19% in the last 2 years, respectively.

Rest of APAC has grown at a 14% CAGR, however 2024 grew only at 6.4%

If we assume the geographical growth rates of 0% Italy, 7% Rest of EMEA (two-thirds of 2024 growth), 16% Americas (two-thirds of 2024 growth), 0% Mainland China/HK/Taiwan, and 4% Rest of APAC (two-thirds of 2024 growth) then we get to €7.2 which is also equal to consensus.

Forecasts and DCF Valuation

Consensus estimates for revenue growth for the next three years are 7.9%, 9.9%, and 7.4%, respectively. I’m going to assume the 7.4% continues until the end of the decade and a 4% growth into perpetuity. This results in a 7.7% forward CAGR vs 9.2% for the last decade. The company's 2025 outlook is for >5% growth or >€7 billion. So to be clear, I’m being more aggressive.

Consensus for operating margin is 29.1%, 29.9%, and 30.3% for the next three years. I’m going to assume 30.3% continues forever. The company outlook is 29.0%, so again, I’m being more aggressive.

For CAPEX and depreciation & amortization I’m using consensus, and then dragging that out based on % of sales. Management has guided to €900m CAPEX while consensus is €918m, a small difference. For terminal value, I always back out a net CAPEX based on ROIC.

Based on the assumptions made, I came up with a €295 intrinsic value (DCF summary below). Looks like Exor made the right call in taking some profits!

So I’m not interested in Ferrari stock and personally believe it is likely to slide (or drift, pun intended) lower. The DCF above does not assume a hiccup in forward growth, and a 7% WACC just makes me gringe. Jack that up to 8%, and then you need to believe a 6% growth for the terminal value for the current price to make any sense. Keep in mind the forward decade has assumptions that are more aggressive than the company’s outlook!

Even at €250 (versus c€386 today), the P/E ratio would still be 25x. So while I’ll walk up and stare at any Ferrari, you’ll see my feet spin like the roadrunner away from the stock. Let me know what you think in the comments If you like my pieces, please subscribe so more people can find them!

Disclaimer: Not investment advice. Do your own work! This account is not operated by a broker, a dealer, a registered investment adviser, or a regulated entity. Under no circumstances does any information posted represent a recommendation to buy or sell a security. In no event shall the author be liable to anyone reading this post for any damages of any kind arising out of the use of any content available in this post. Past performance is a poor indicator of future performance. All the information on this substack and any related materials is not intended to be, nor does it constitute investment advice or a recommendation. All materials and information you obtain here are exclusively for informational purposes and do not constitute an offer or solicitation to provide any investment services to investors based in the U.S. or elsewhere.

I agree. I will look, but not touch!