A couple of years ago, my friend Ole Soeberg pitched Novo Nordisk, putting emphasis on the potential success of a miracle weight loss drug. I was a skeptic and didn’t pay enough attention. Wegovy took the market by storm and the stock soared! Fast forward to today, the stock has pulled back significantly. Novo’s next generation weight loss drug CagriSema only achieved a 15.7% weight loss in a test group. A success versus the placebo group (3.1%) but below expectations of 25%. Competition from Eli Lilly along with political and regulatory risks have weighed on the stock that has slimed down (pun intended). Time to take a ‘first look’ to see if this stock is interesting enough to consider for my portfolio.

Market Info

Ticker: CPSE:NOVO B (Capital IQ)

Ticker (ADR): NVO

Stock Price (Local): 437.40

52-W High (June 26, 2024): 1,033.20

52-W Low (April 9, 2025): 398.25

5 Year Beta: 0.25

Avg Volume (3-month, millions): 5.1

Avg Volume (USD, millions): 337.5

Shares outstanding (basic): 4,439

Country of Incorporation: Denmark

Trading Currency: DKK

Filing Currency: DKK

Enterprise Value

(Figures on the left are in USD, and on the right are in DKK)

Market Cap (millions): $294,670 | DKK 1,934,761

Plus: Total Debt $14,269 | DKK 102,787 of which Leases $939 | DKK 6,766

Less: Cash and ST Investments -$3,652 | DKK -26,308

EV (millions): $305,287 | DKK 2,011,240

Key Valuation Metrics

P/E forward 16x

EV/EBITDA forward 11.4x

Dividend Yield 2.6%

Key Persons

President, CEO & Member of Mgmt Board: Jorgensen, Lars

Executive VP, CFO & Member of the Mgmt Board: Knudsen, Karsten

EVP of Product Supply, Quality & IT and Member of Mgmt Board: Wulff, Henrik Board of Directors, Chairman: Lund, Helge

Top 5 Institutional holders:

Novo Holdings A/S 28% (holds voting control via dual-class shares)

BlackRock 5%

Vanguard 3%

Norges Bank Inv Mgmt 2%

GQG Partners LLC 1%

Performance

The pullback has affected the long-term performance. The 5-year and 10-year performance CAGR is below its earnings growth.

5-year chart shows the stock revisiting 2023 levels but is still above 2021 (the year Wegovy got FDA approval). In FY2022 Novo’s obesity drugs recorded a 101% growth in revenues.

Forecasts and DCF Valuation

I took consensus estimates for revenue and operating profit for the next 3 years and then stepped down growth to a 3.7% in 2031 (equal to the average growth in diabetes revenues from 2016-20). Do these assumptions and consensus make sense?

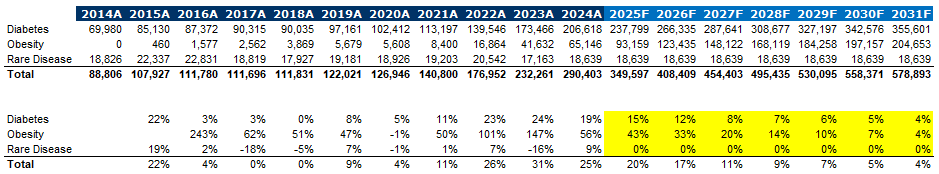

In the table below is a sales breakdown of the segments for the last 10 years along with a forecast based on assumptions for growth in yellow. Numbers on top are revenues in DKK and below is the annual growth.

The company has guided sales growth of 16-24% in constant currency for 2025. c3% higher for reported currency or 19-27% total. Consensus is at 20% and is achievable if diabetes slows to 15% growth and obesity to 43%. Rare diseases have done nothing for the past decade so 0% growth is assumed going forward. Diabetes and Obesity are both modeled to slow. The model implies an c8% forward 10-year CAGR vs c13% historically. (Keep in mind this is not a deep dive and I have not analysed all the company’s drugs to come up with more sophisticated numbers).

Operating margin is also reduced to 43% long-term (vs 46% consensus for the next 3 years) which brings it back in line with the 2015-22 era.

The company has guided for c65b in CAPEX and FCF of 75-85b, and I’ve kept roughly in line with that for FY25. Looking forward, I brought that number back down to be in line with historical investment levels (as a % of sales).

The intrinsic value comes out to DKK 626 per share which is significantly higher than the current price of c430.

So what is the market telling us?

If we take mid guidance of 80b in FCF and assume a 4.5% forever growth rate (vs the 13% 10-year Sales CAGR) then the value of the stock is DKK 433. Also note, the 7-year Sales CAGR between 2014-21 was 6.8%. The market has placed this stock in the dog house and is pricing in lower growth than the analyst community.

Who do you think is right? Let me know in the comments!

Disclaimer: Not investment advice. Do your own work! This substack is not operated by a broker, a dealer, a registered investment adviser, or a regulated entity. Under no circumstances does any information posted represent a recommendation to buy or sell a security. In no event shall the author be liable to anyone reading this post for any damages of any kind arising out of the use of any content available in this post. Past performance is a poor indicator of future performance. All the information on this substack and any related materials is not intended to be, nor does it constitute investment advice or a recommendation. All materials and information you obtain here are exclusively for informational purposes and do not constitute an offer or solicitation to provide any investment services to investors based in the U.S. or elsewhere.

What about potential U.S. tariffs on pharma?