Last summer I went long Ryanair. I was so confident about the stock that I presented it at FatAlpha Value (Cyprus) in September. The stock has made new highs, and so it’s time to review the position and update the valuation.

Side note: If you like great stock ideas (who doesn’t, right?) then check out the Online event I’m organising at the end of the month (click here) with an amazing roster of fund managers and experts presenting. I’ve been organising exclusive by-invitation in-person events for the past decade. The flagship September event is fully booked 8 months in advance. Through this Online event, I’m making high-quality content previously reserved for a select group of investors available to everyone. Check it out: https://fatalphavalue.com/online

Cost Leader

Now I don’t think Ryanair needs much of an introduction. You probably already hate the airline (due to baggage fines) or admire it for its incredible management. The no-frills low-cost airline model was inspired by Southwest Airlines, which its CEO, Michael O’Leary, studied in the 1990s.

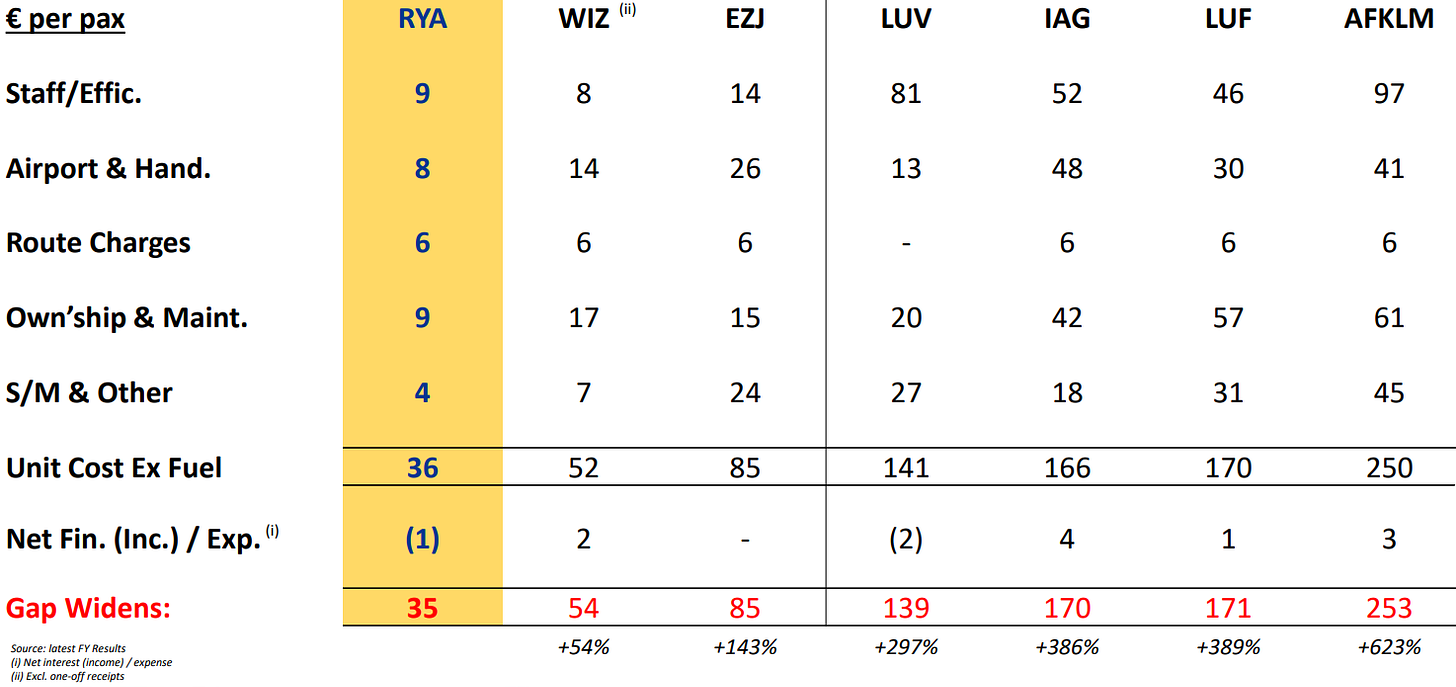

Below is a table that Ryanair loves to include in their quarterly presentation showing the cost per passenger, excluding fuel costs. The comparison is with Wizz, EasyJet, Southwest, International Airlines Group, Lufthansa, and Air France-KLM.

The initial pitch was simple. The cost leader in short-haul flights saw a drop in the stock price due to weaker pricing than expected. Long-term, the picture was and remains intact. The company is led by aligned management and continues to grow by adding more planes and passengers, while maintaining a strong balance sheet. The majority of the planes are owned by the company, while cash exceeds debt. The company will be “entirely or almost entirely debt-free” by May 2026 as they will pay down all their maturing bonds (see 4Q25 transcript).

Market Info

Ticker RYA

Stock Price (Local): 23.28

52-W High (June-11-2025): 24.65

52-W Low (July-23-2024): 13.41

5 Year Beta: 1.30

Avg Volume (3-month, millions) 3.6

Avg Volume (USD, millions) 97.8

Shares outstanding (basic, millions) 1,062

Country of Incorporation: Ireland

Trading Currency: EUR

Filing Currency: EUR

Enterprise Value

(Figures on the left are in USD, and on the right are in EUR)

Market Cap (millions): $28,587 | €24,730

Plus: Total Debt $2,900 | €2,683 of which Leases $161 | €149

Less: Cash and ST Investments -$4,284 | -€3,963

EV (millions): $27,202 | €23,450

Key Valuation Metrics

P/E forward: 12x

EV/EBITDA forward: 6.7x

Dividend Yield: 1.9%

Key Persons

Group CEO & Executive Director: O'Leary, Michael

Group Chief Financial Officer: Sorahan, Neil

Chief Technology Officer: Hurley, John

Board of Directors, Chairman: McCarthy, Stan

Top Holders - Aligned Management

As you can see below, the CEO is one of the largest shareholders in the company. Now, if he remains CEO until 2028 (realistically, only if he drops dead will anything change that), he is eligible to receive a €100m share options package because the stock has traded above €21 for 28 consecutive days. Options don’t vest until 2028. This legend of the airline industry has been the CEO since 1994, while he was the CFO before that. He is only 64 years old, so I’m speculating he sticks around. For comparison, Steven Hazy, who basically created the air leasing industry, only just retired from Executive Chairman at age 79 and will still stick around Air Lease as Non-Exec until 2026.

If you haven’t listened to Michael O’Leary, I highly recommend it. Passionate and candid. He isn’t afraid to call out the problems he sees in the industry. This is the type of management you want in every investment.

Capital Research & Mgmt: 13%

HSBC Global Asset Mgmt: 13%

Massachusetts Fin Services Co: 11%

Parvus Asset Mgmt: 9%

BNP Paribas Asset Mgmt: 5%

O'Leary, Michael 4%

Stock Performance

Despite the stock making new high-time highs, it has essentially tracked earnings growth! The 10-year stock CAGR is at 7% vs 9% for EPS.

X marks the spot! Long from €15, I wish all my investments worked so smoothly!

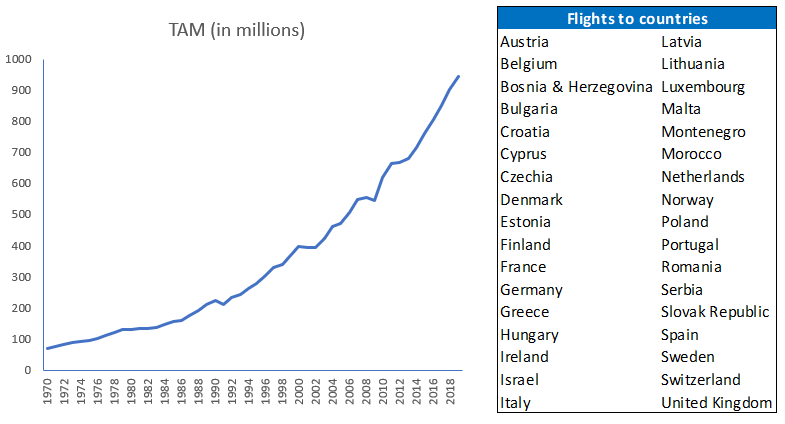

Target Addressable Market

Using data from the World Bank and focusing on the countries that Ryanair operates, I calculated that the TAM has been growing at c. 5.5% regardless of the period examined (1970-2019, 2009-19, 2014-19). Ryanair’s 2034 target of 300m passengers is a c. 5% CAGR, so assuming the TAM continues in line with history, any market gains are just cream on top.

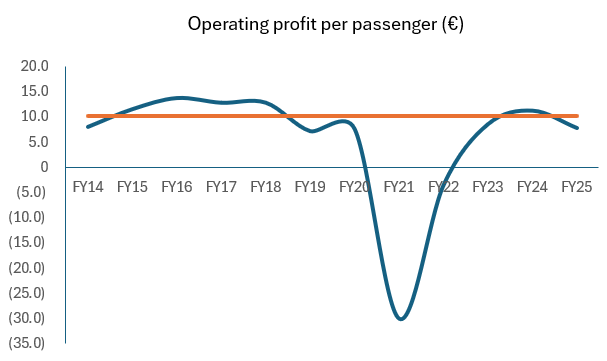

The argument I had made in September was that Ryanair was overearning in 2024 and so 2025 was more of a normalization rather than some big miss. See the chart below on the left. From 1Q23 to 1Q24 the ticker price rose +42%, so despite the -15% in the following year the ticket price (€41.9) was still +21% above the price from 2 years ago (€34.6)

Historically, ticket prices have been in decline, dropping at a -1% CAGR over 2014-23. If we update with FY25 numbers, it’s essentially flat at a -0.1% CAGR. Ancillary revenues (eg. baggage fees, priority boarding, seat allocation, food) have basically picked up the slack as they grew in the low single digits.

If you are one of the geniuses (or my wife) who thinks you can get away with sneaking in a little extra baggage but then pays a fine, then you think “I hate these greedy [insert swear word] ”. The reality is that Ryanair doesn't make as much money as people think. On average, they generate operating profits of €10 per passenger, and that’s before they pay the taxman. This just goes to show how difficult this industry is. The cost leader with the ideal management still only makes a tenner! Imagine if they had a lot of debt. Then any downturn would be a problem.

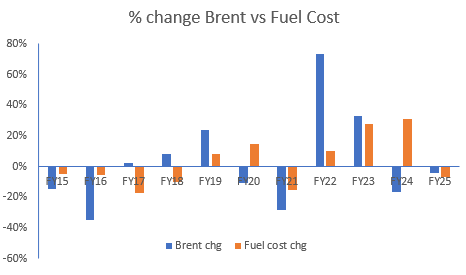

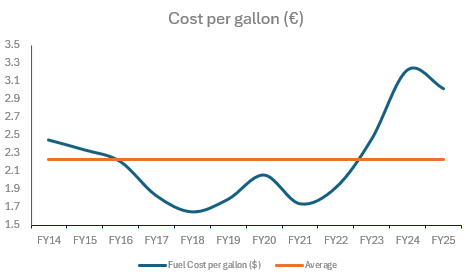

Fuel Cost is a big deal

Beyond some hedging, there isn’t much more Ryanair can do about fuel cost, which is the largest cost item. In FY25, the cost per passenger was €62, of that €26 was fuel! Generally speaking, the price of oil and Ryanair’s fuel cost move in the same direction. In the last call, it was mentioned that they have already secured a 4% saving from the 85% hedge, and that with Brent trending lower, they will have additional savings on the 15% that is unhedged.

The average fuel cost per gallon has been above historical levels for a while. The average is €2.23 vs FY25 at €3.02

For FY26, if we assume the 4% saving mentioned on the call and that Brent is 20% lower (in euros) and apply that to the 15% unhedged, then fuel could be -6% lower. That saving is amplified when we consider that Ryanair has guided to 3% higher passengers, as well as a ‘cautious’ expectation of a partial recovery in -7% ticket fares from the prior year. Though it should be noted that they have said they have zero visibility on the second half.

Peers

I used the same peers that Ryanair does and added Jet2 as it is a British low-cost airline with similar historical growth. Note, though, that a lot of Jet2’s tickets are due to the packages the company sells.

Ryanair’s P/E is the highest (excluding Southwest).

On an EV/EBIT basis, the comparison is better, and we see the pop in the multiple of Wizz due to their higher levels of debt.

Forward sales growth is good for the entire sector, with Ryanair in-line with the other airlines.

Forward EPS growth is also good for the entire sector, which will benefit from lower fuel costs.

Ryanair shows strong ROE and EBIT margin

The 1-year stock performance is the second strongest, while Wizz is the weakest.

Below is a summary table for your convenience.

Valuation

In my detailed model, I made a number of assumptions. I discuss some of these below. The main revenue assumptions I made are reasonable and below guidance.

Ticket prices to rise 4% in FY26 (in line with the partial recovery mentioned on the call) but then decline -0.1% a year going forward. This implies a ticket price below €48 for all years forecasted. Note that in 2022 (FY23: €41), the CEO said on BBC that the “40 euros needs to edge up toward maybe 50 euros over the next 5 years”

Ancillary to rise 3% going forward, in line with the last few years, but below the long-term rate of 4%

Passengers to grow to 288m by 2034. Below Ryanair’s guidance of 300m but in line with my estimates of load factor, the flight size, and the number of seats per plane configuration

Some of the assumptions for expenses include

Fuel: a -6% decline in FY26 and then a constant cost per mile. As the cost is above historical, I believe this is conservative.

Staff costs to rise along with the fleet size and a 3% salary inflation

Airport and handling charges to rise in line with historicals.

Taking into account a 11% tax rate, I estimate a profit of €1,9bn while analysts consensus is at €2.0bn. On a per share basis, I forecast €1.74 (taking into account the €750m buyback) while consensus is at €1.93.

For CAPEX I took into account management guidance and then made an forecast based on the size of the fleet.

My DCF uses a 3% growth for terminal value and a 10% WACC. Fair value is €28.

Other ways to think about it:

I estimated free cash flow of €1.7bn for FY26 (with consensus at €2.1bn). That implies a 7% and 9% FCF/EV respectively.

Just assuming a 3% growth on the FY26 FCF, would imply a fair value that is 7% higher. That’s without growing the fleet or any other efficiencies.

You are paying only 11-13x earnings for an excellent company that is still growing and paying dividends

Assuming the airline carries 288m passengers and continues to do buybacks at a similar rate as the past then EPS will grow to €3.85 by 2034. A 12 P/E imples a 9% CAGR from today without including the dividends.

Note that the options payoff would trigger if profits rise above €2.2b (or >€2.00 EPS). That tell us that the company expects profits much higher. Obviously at €15 it was a no brainer and wish I had bought more. But taking into account the above, it’s still reasonably price. So I wouldn’t be surprised to see the stock move higher and that’s my base expectation.

Let me know what you think in the comments and don’t forget to check out the Online Event: https://fatalphavalue.com/online

Disclaimer: Not investment advice. Do your own work! This account is not operated by a broker, a dealer, a registered investment adviser, or a regulated entity. Under no circumstances does any information posted represent a recommendation to buy or sell a security. In no event shall the author be liable to anyone reading this post for any damages of any kind arising out of the use of any content available in this post. Past performance is a poor indicator of future performance. All the information on this substack and any related materials is not intended to be, nor does it constitute investment advice or a recommendation. All materials and information you obtain here are exclusively for informational purposes and do not constitute an offer or solicitation to provide any investment services to investors based in the U.S. or elsewhere.

Have a look at JET2.