Magic! More Ideas From Another Screen

Output from a multi-factor model

A few people told me they enjoyed the article with the multi-factor model (here) so I decided to do another piece highlighting the results from another model. But again with my own twist.

One very popular screen is Joel Greenblatt’s ‘Magic Formula’ that he talks about in his best-selling book “The Little Book that Beats the Market”. This screen is a ranking system using ‘return on capital’ and ‘earnings yield’. By earnings yield, he means the inverse of EV/EBIT. It’s a multiple that backtests well, along with EV/EBITDA. O’Shaughnessey has some good data on that. My advice for people would be to buy that book (click to article) instead, as it’s significantly richer in information.

Greenblatt creates a combined ranking based on earning yield (lower is better) and return on capital (higher is better), and has some suggestions for a quantitative strategy. In all honesty, I have some doubts regarding his backtested claims. Regardless, there is solid logic in the approach. A good company should have a high return on capital, and a low multiple indicates a potentially cheap stock.

Too many people ignore returns, so let’s discuss this in the simplest manner. Imagine if I told you I had a fantastic idea that would return 7% risk-free! Sounds great, right? But what if I then told you that I borrowed from the bank at 10% and invested it in that idea? You would then call me an idiot. I’m destroying my personal wealth.

However, investors are constantly buying stocks of companies that do exactly this. Check your portfolio! If a company has a return on equity of 5% when its cost of capital is above that, then it is destroying value.

I have two twists to the screen. Firstly, instead of return on capital, I’m using return on equity for two reasons a) ROC and ROIC can be defined differently by various screens and websites, while ROE is consistent, b) ROE stats are more readily available to investors. Secondly, I will screen for companies that have a 20%+ ROE in each of the last 3 years. The purpose of that is to filter out companies with a temporary boost in ROE. Of course, this still doesn’t mean that these companies are great.

I started with c. 90 thousand equities listed in Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Indonesia, Ireland, Israel, Italy, Japan, Luxembourg, Netherlands, Norway, Poland, Portugal, Singapore, Spain, Sweden, Switzerland, United Kingdom, and the United States. After applying the 20% ROE threshold for the last 3 years, and a market cap greater than EUR 100m I was left with c. 3,000 companies. By keeping only the primary listings, I was down to c. 900, and as a final filter, companies had to have a forward multiple of EV/EBIT. c. 700 were left.

Each company got a score for EV/EBIT and a score for ROE. Each score places them in a bucket from 1 to 100, and then the scores were combined. The top 24 companies are shown below.

Travelzoo makes most of its money from advertising fees charged to airlines, hotels, etc for being on their platforms. They also started a subscription-based membership model last year. Stock has exhibited some crazy spikes (chart below). It was almost $25 in February but is now around $13. First quarter results disappointed as sales rose, but operating profit dropped because of costs associated with member acquisitions. I can’t even visit the website without registering. I’d call that bad marketing. Good luck. I’ll pass.

Temu owner PDD Holdings is on the list, but in my opinion, an investor is safer holding Tencent, which owns around 15% of PDD. Temu has done well selling cheap junk, but the closure of the “De Minimis” loophole that allowed goods under $800 into the US duty-free has closed. Furthermore, I wouldn’t be surprised if they get hit by fines regarding deceptive marketing. I bought stuff once and I keep get notifications of all the free stuff they want to send me :)

Carote has its headquarters in China and sells kitchenware worldwide, with 66% of its revenue from the United States. Growth has been stunning (106% in 2023, 31% in 2024), and it’s expected remain high (consensus for next 3 years: 30%, 26%, 17%). The stock is trading around its HKD 5.78 IPO price (2024 listed in Hong Kong), but those who bought after the listing are underwater (52-week high 10.88). Consensus sees the operating margin weaking to 14% from 19% in 2024. The company is sitting on HKD 1.3 billion versus a market cap of HKD 2.8 billion and no debt. Still the only kitchenware I may buy is Gordon Ramsay’s HexClad, though my wife may kill me :)

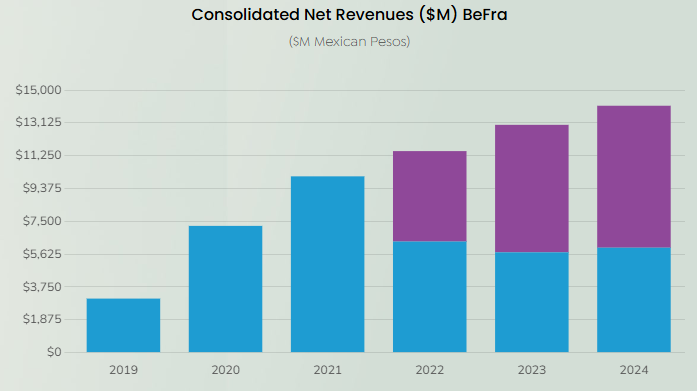

Betterware de Mexico also sells household goods, but in 2022 they bought Jafra (beauty products) which is now the largest revenue generator (Jafra in purple below). The stock has traded at a 5-6x EV/EBIT multiple for the last 5 years, so not that cheap historically.

Matahari is Indonesia’s largest department store. The stock has taken a dive over the last few years (see below). After double-digit growth in 2021 and 2022, top line was flat in 2023, but margins declined and has been flatish in 2024. Still, the company generated around IDR 1.7 trillion versus an enterprise value of IDR 3.8 trillion. Note that depreciation has massively exceeded capex. Cash on hand also cancels out debt. Department stores are a tough business, and I generally avoid them, but if you can invest in Indonesia, then it could be interesting.

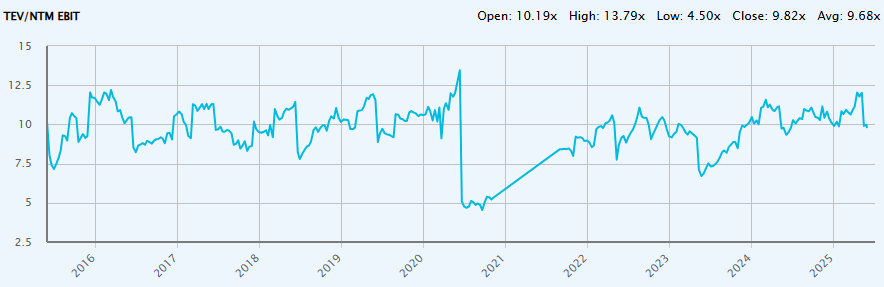

PT Multi Bintang Indonesia makes money producing and distributing Bintang and Heineken beer in the country. 89% of the company is owned by Heineken. Revenues and operating profit have been pretty much flat for some years now. As the company has excess cash on hand there are dividend payments, which are roughly equal to the FCF. Dividend yield is around 10% (10-year Indonesia Sovereign trades around 6.8%). The EV/EBIT multiple is historically on the low end (see below), while the company generated around 11.3% FCF yield to EV.

H&R Block is an interesting one, despite that it looks like it’s trading at its historical level. The company made over $620m FCF. Assuming a 3% growth and a 9% WACC, you get a value of around $70. The biggest threats are probably DIY software like TurboTax (owned by Intuit) and AI. Why pay anyone when you can now just ask Gemini or ChatGPT?

Three companies come from the Energy Sector. Geopark and Hemisphere are upstream E&P companies, so their businesses are directly affected by the price of oil.

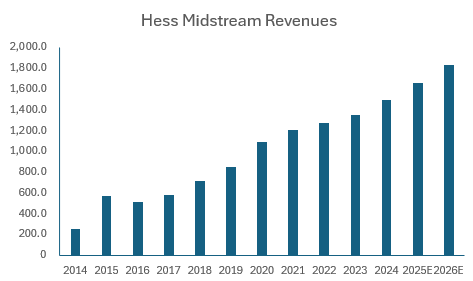

Hess Midstream LP owns the pipelines and systems which oil travels. They charge a fee (toll business) with Hess as its main client. Hess (owns c. 40%) is being acquired by Chevron, so Chevron will become their new main client. The contract with Hess is until 2033, and there are minimum volume commitments, so theoretically, nothing should change. The stock has done well, compounding at a 15% CAGR for the last 5 years, along with EPS. While the company used to be an MLP, it’s converted to an U-C Corp. So for new investors, it’s my understanding that it’s similar to a C Corp with the exception of the existence of a Tax Receivable Agreement (TRA) that is a benefit to the original owners. With a c. 7% dividend yield, repurchases, and growth (per consensus) it’s an interesting one for further work.

Unlike Hess Midstream, Westlake Chemical Partners is an MLP. They own and run ethylene production plants in the United States. 95% of the production is sold to Westlake Chemical at a cost-plus basis ($0.10 per pound). Due to tax complexities, I avoid MLPs. Stock has been flat for some time:

Yu Group is a UK-based independent supplier of gas, electricity, and water, primarily to business customers. The largest shareholder is the CEO Baljit Kalar, who owns c. 52% of the company. The one-stop shop may be attractive to some businesses. No view on this GBP 360m market cap company.

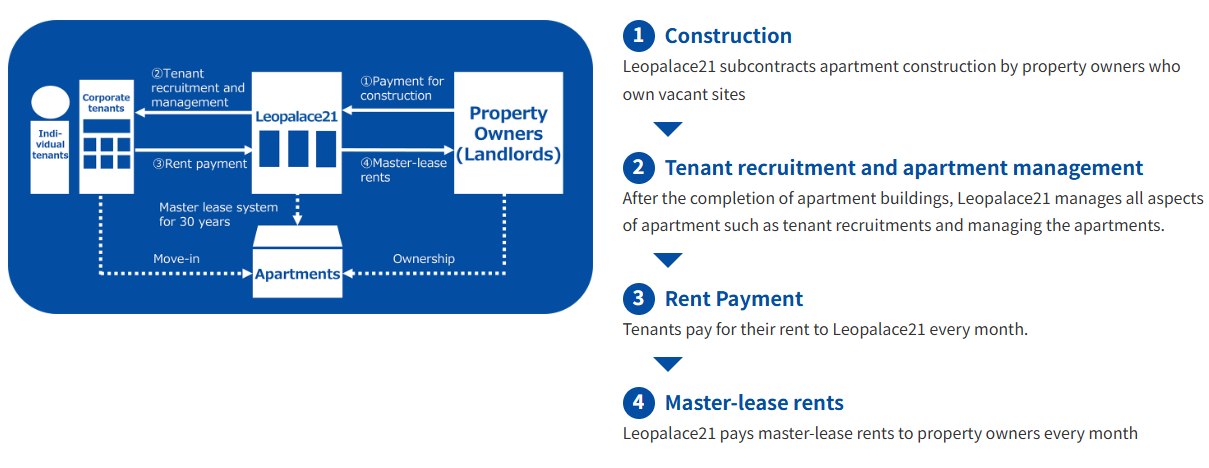

Leopalace21 is a Japanese real estate company whose core business is the leasing and management of residential apartments. It pays rent to property owners via long-term master-lease rental agreements and collects from tenants. Chidori LLC and Hikari Tsushin Inc together own around 45%. Historical EBIT margin is mid-single-digit.

A snippet from the business model (found here):

Two transportation companies: 1) Hoegh Autoliners: roll-on/roll-off ocean transport services (basically wheeled cargo such as cars, bulldozers, tractors, trailers, etc), 2) IAG, which was also in the May 15 screen. IAG’s free cash flow jumped in 2024, but historically doesn’t look that strong.

If you like gold, then you see Steppe Gold made the list. A mining company operating 2 mines in Mongolia. The company is listed on the Toronto exchange and typically with these, a small cap, with CAD 233m market cap.

SHAPE Australia offers commercial construction services in Australia. Low-single-digit EBIT margin business, while the stock only does around AUD 200k a day.

FSE Holdings owns 75% of FSE Lifestyle Services. The company offers property management services, electrical and mechanical (E&M) engineering Services, but its largest segment is City Essential Services, which consists of a range of services.

Text S.A. (previously known as Livechat) offers exactly that! A chat platform, along with additional services. I was interested in it personally when it dropped below a hundred. A friend and I had a call with IR, and there was a lot to like (especially the dividend), but I couldn’t get comfortable with the business model. There is a lot of churn, which means they have to constantly find new customers for what appears to me to be a commodity product (their competitors offer the same features). They do have a cost benefit as they are a Polish company, so the question is if that’s enough? I was right to avoid the stock as it slid lower (see below). Perhaps time to revisit.

5 companies have some type of financial services aspect:

The well-known money transfer company, Western Union. With revenue and margin declining, the low valuation could be justified.

Olympia Financial’s core business is fees from self-directed registered plan accounts (RRSPs, RRIFs, LIRAs, LIFs, TFSAs). CAD 100m revenues expected to be flat.

GQG Partners is an investment management firm. I’m not interested in asset managers.

Pluxee could be an interesting case. Spun off from Sodexo, they operate in the employee benefit space. Basically, instead of giving employees cash for lunch, they give them a Pluxee car or app. If they are able to earn money off the float and if there are network effects, then there could be potential. But if someone can just show up tomorrow and easily replicate, then it’s a no-go.

Kaspi is also on the list, and this is among the most interesting cases. Imagine Amazon, Paypal and Revolut all rolled into one. It’s been a favourite among many value investors, but the stock has stumbled due to a drop in growth. Their move into Turkey has also raised some questions. Also investors long Kaspi are exposed to Kazahkstan risk as the majority of the revenues are from there. If they can repeat in Turkey what they achieved in Kazahkstan then the current price could indeed be a bargain!

Any of the companies in this list look interesting to you? Let me know in the comments!

P.S. Soft launch of my new events page. Will have a lot of exciting news soon! Check it out: https://fatalphavalue.com

Disclaimer: Not investment advice. Do your own work! This account is not operated by a broker, a dealer, a registered investment adviser, or a regulated entity. Under no circumstances does any information posted represent a recommendation to buy or sell a security. In no event shall the author be liable to anyone reading this post for any damages of any kind arising out of the use of any content available in this post. Past performance is a poor indicator of future performance. All the information on this substack and any related materials is not intended to be, nor does it constitute investment advice or a recommendation. All materials and information you obtain here are exclusively for informational purposes and do not constitute an offer or solicitation to provide any investment services to investors based in the U.S. or elsewhere.

Thanks for the review! I own a lot of Kaspi and a bit of Geopark. Both are laggards in my portfolio :)

Greenblatt's book generally makes sense to me, but the automated strategy doesn't seem to work judging by a few tests published online.