Smart Takes from Smart Money

Sharing a few reflections from the FatAlpha Value Online Conference

I hosted the first-ever FatAlpha Value Online Conference on June 27–28 with 102 attendees (70% professionals) and 12 speakers. Thought I’d share a few reflections.

Attendees rated it 9 out of 10. If anything below strikes a chord, you might want to check out the recordings. 👉 https://fatalphavalue.com/online

AI for Analysts: Less Glamour, More Utility

Michael Fritzell's walkthrough of generative AI in research was very practical and hands-on. It was the highest rated session.

He’s not replacing himself with ChatGPT, but he is using it to summarize filings, translate documents, and even flag inconsistencies in management commentary. Proper usage can turn a one-person research shop into a small team!

Michael did admit AI’s many limitations, including the well-known hallucinations. His key was in the "prompt engineering," knowing exactly how to ask for what you need and how to cross-verify the output. Below is 1 example out of 15 that he gave:

My takeaway is that you can and should use AI to speed up your process and learning when researching companies. But you have to verify and do your own critical thinking before you actually pull the trigger. I really liked Michael’s session, and I plan on re-watching it.

His profile:

Michael Fritzell, CFA. Based in Singapore, over the past decade, Michael is the author of Asian Century Stocks, a Substack publication covering Asian equities. Before launching Asian Century Stocks, Michael was a portfolio manager at a European family office called Dunross & Co and an analyst at a Shanghai-based fund manager called Asia Growth Investors, now part of a larger group called East Capital.

Avoiding Valuation Mistakes

Andrew Stotz was our first speaker and opened the conference with a topic that may appear basic, but isn’t. Even the professionals took notes when Andrew dug deep into the errors investors and analysts can make. He provided a 170-page deck that all the attendees can keep and review in their own time.

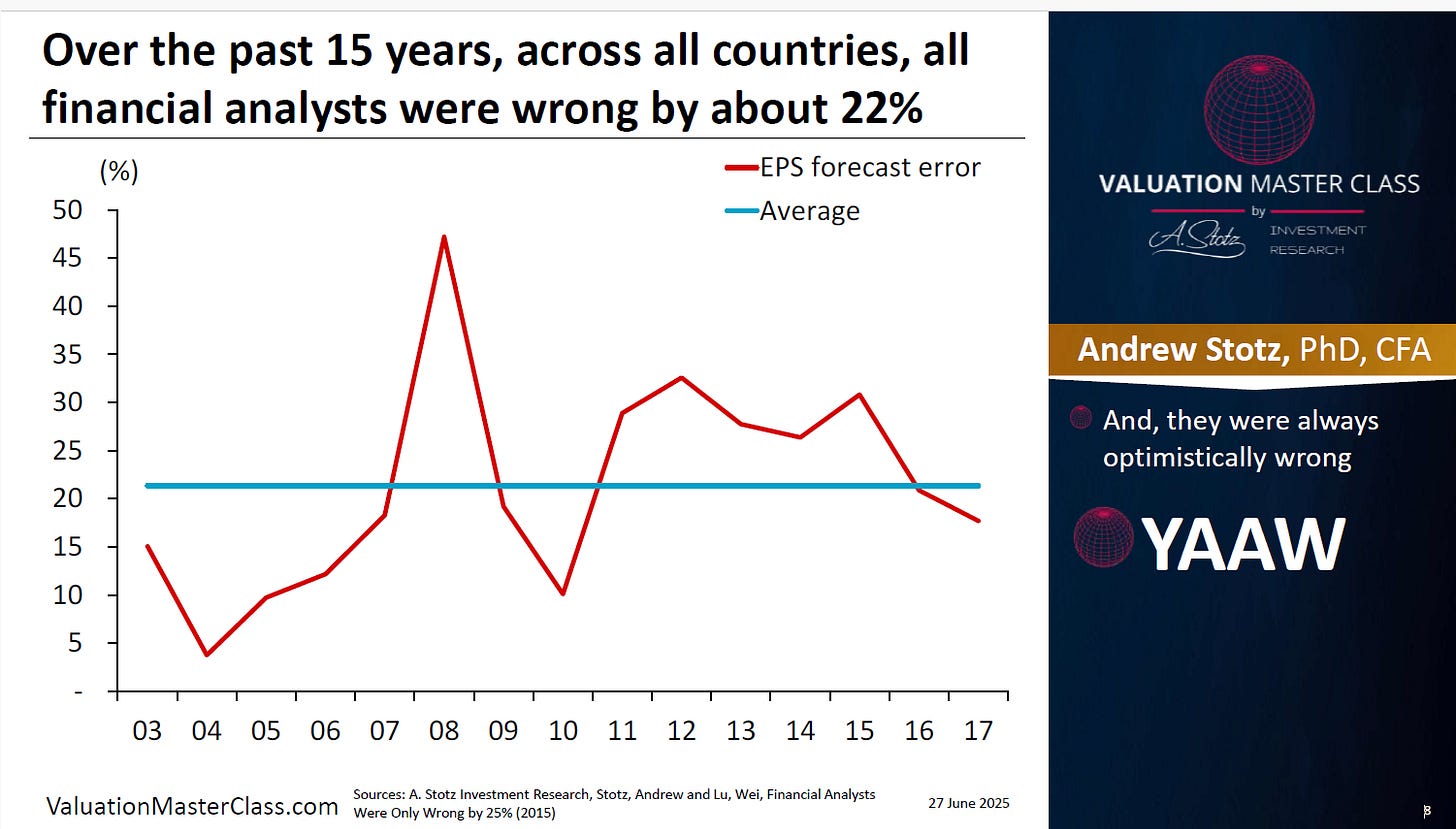

He argued against the hockey-stick revenue forecasts and heroic margin assumptions that plague analyst models. Andrew shared a lot of his own proprietary research that was done on thousands of companies over a long period. For example, the slide below shows how that over the past 15 years, analysts were wrong by c. 22% on their EPS forecasts!

His solution is simple: use global industry averages as a baseline reality check. We discussed the concept of "fade" with regard to growth and ROIC, cost of equity and several other important factors on valuation. I’m going to go through that deck with a fine-tooth comb!

His profile:

Andrew Stotz, PhD, CFA. He has over 30 years of experience as a financial analyst and was twice voted Thailand’s #1 financial analyst. He’s developed investment strategies managing over $70 million in assets and taught finance for three decades at top institutions and online, impacting thousands. He co-founded CoffeeWORKS, navigating it through financial crises, and leads A. Stotz Academy and A. Stotz Investment Research. Dr. Stotz’s lifelong learning journey includes reading 3,000+ books, earning a CFA, and pursuing a Ph.D. at 50. He has interviewed about 800 people on his “My Worst Investment Ever” podcast, has authored five books, and created innovative financial tools and courses, including Valuation Master Class. A respected leader, he’s been a head of research, president of CFA Society Thailand, and advocates for ethical finance education. He embraces Thai culture as a naturalized citizen.

Berna Barshay: Crocs (CROX) — Mispriced, Misunderstood, and Still Growing

Berna made a strong case for Crocs, arguing that the market is unfairly punishing a company that continues to deliver on above-industry growth, cash flow, and capital allocation.

Her key points:

Crocs are no fad: Despite persistent investor skepticism, while sales growth rates have normalized, demand for the flagship Crocs brand has been steady in the US and continues to grow internationally. The longtime bear case of a reversion to an imaginary mean for both the size and margins of this business has been refuted by results.

Hey Dude is a free call option: While Hey Dude has recently stumbled after being fast out of the gate post-acquisition in 2021, it's too soon to write off the brand as permanently in decline given an established core fan base and a strong leadership team behind it.

Cash flow machine: The company is producing strong free cash flow and is aggressively buying back shares.

Valuation disconnect: Crocs is priced like a fad, not a business with real staying power. At a high single-digit P/E, it’s trading at a steep discount to both its history and peers, despite outperforming many of them operationally.

Her bottom line: Crocs doesn’t need to win any beauty contests. It just needs to keep executing and at this price, it doesn’t have to do much to outperform low embedded expectations.

In full disclosure, I also personally own the stock. I think it’s a case where I can’t lose, and Hey Dude could supercharge it. Great discussion with Berna that continued into the networking session at the end of the day, where she also shared thoughts on other consumer stocks as well.

Her profile:

Berna Barshay. Berna has three decades of experience as a hedge fund analyst, portfolio manager, and trader. She has been a research contributor to the Public investing app and the author of the Empire Financial Daily, a financial newsletter with over 200,000 subs. Berna began her Wall Street career at Goldman. She has her BA from Princeton and MBA from Harvard. She lives in New York City with her husband, daughter, and their three rescue dogs.

She is also a partner at Wall Street Beats.

Summary

The event had 16 sessions. In addition to Crocs, there were 2 other extensive deep dives, as well as stock ideas throughout the sessions. Plenty of relevant topics (South East Asia, Africa, Eastern Europe, Geopolitics, Practical Application of Advanced Option Strategies, etc) and lots of ideas from around the globe for people to look into. There was so much value that I think if someone only watched 1 of the sessions it was worth it.

Both the attendees and I were happy with the result:

“Great online event. For an online event, it was very dynamic, frictionless, and featured a very interesting variety of speakers. I really liked the focus on practical cases, but I also found the presentations on geopolitics, investment philosophy, common mistakes, etc., extremely interesting.”

Event link and recordings: https://fatalphavalue.com/online

Some of these speakers I’ve known for some time, and have done podcast episodes with them. If you want to check those out, then click on the name: Harvey Sawikin, Pon Van Compernolle, Tim Staermose, Adam Siegel, Evan Tindell, and Jeff Gilbert.

For a limited time, I’ll bring those who buy the recordings into the new Online community chat. Also, I’ll be doing 2 workshops on Friday so anyone who gets involved soon will also be invited to the bonus workshops.

Disclaimer: Not investment advice. Do your own work! This account is not operated by a broker, a dealer, a registered investment adviser, or a regulated entity. Under no circumstances does any information posted represent a recommendation to buy or sell a security. In no event shall the author be liable to anyone reading this post for any damages of any kind arising out of the use of any content available in this post. Past performance is a poor indicator of future performance. All the information on this substack and any related materials is not intended to be, nor does it constitute investment advice or a recommendation. All materials and information you obtain here are exclusively for informational purposes and do not constitute an offer or solicitation to provide any investment services to investors based in the U.S. or elsewhere.