The 101 year old company has seen its stock drop around -21% YTD vs -8% for the S&P. Will the cord cutters bring an end to the Mouse? Time to take a look at this legendary company, its revenues, and the operating profits generated by each segment. Finally, as in all my pieces, I’ll calculate its intrinsic value.

Market Info

Ticker: DIS

Stock Price (Local): $82.77

52-W High (December 02, 2024): $118.63

52-W Low (April 7, 2025): $80.10

5 Year Beta: 1.44

Avg Volume (3-month, millions): 10.3

Avg Volume (USD, millions): $855.0

Shares outstanding (basic): 1,808

Enterprise Value

Market Cap (USD, millions): $149,631

Plus: Total Debt $45,308 of which Leases $3,702

Plus: Minority Interest $4,806

Less: Cash and ST Investments -$5,486

EV (USD, millions): $194,259

Key Valuation Metrics

P/E forward: 15x

EV/EBITDA forward: 10.0x

Dividend Yield: 1.2%

Key Persons

CEO & Director: Iger, Robert

Senior Executive VP & CFO: Johnston, Hugh Senior

EVP and Chief Legal & Compliance Officer: Gutierrez, Horacio

Board of Directors, Chairman: Gorman, James

Top 5 Institutional Holders

Vanguard: 8%

BlackRock: 7%

State Street Global Advisors: 4%

Geode Capital Mgmt: 2%

State Farm (Asset Mgmt Arm): 2%

Stock Performance

Disney shareholders experienced a lost decade! The stock rallied during COVID on the back of the Disney+ launch, but then faded as streaming growth slowed, cord-cutting affected the linear business, and profitability concerns emerged.

This poor performance reflects the lack of growth in earnings, where EPS recorded only a +1% 10-year CAGR and a -3% CAGR in the last 5 years!

Segments

Currently, Disney operates through 3 primary business lines:

1) Entertainment - Linear networks (cable TV), DTC (Disney+ & Hulu streaming services), content sales/licensing

2) Sports - EPSN and ESPN+ streaming service, Star India

3) Experiences - Parks, resorts, cruises, merchandise.

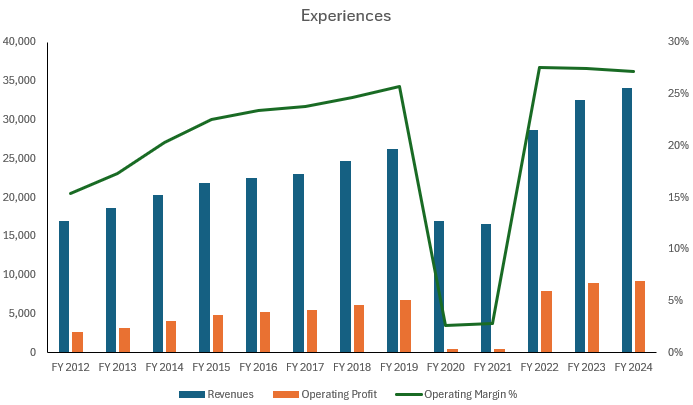

Entertainment is the largest segment however, it is Experiences that is the most profitable. Experiences include parks that were affected by COVID in FY21 and hence why performance was so weak that year.

Experiences has been the crown jewel as it has compounded at a 5-6% CAGR for over a decade while expanding operating margins from c15% to c27% in 2024 driven by an increase in theme park admissions revenues. This is probably of no surprise to any parent who, I expect, will take their kids at least once. The price is inelastic, and Disney executives know it.

If we applied a 20x multiple on Experiences’ operating profit, then it would be worth $185b. That’s more than the market cap of the entire company.

Domestic park revenues are up 59% since FY17, while international are up 72%. More importantly, the operating margin expanded significantly on the international side to 22% from 9% in FY17 while Domestic has been mostly flat.

The Sports segment is one where the company started disclosing data more recently. These are mostly steady at c$17b in sales and around $2.5b in operating profit.

If we applied a 10x multiple on those profits, then we would get a $25b valuation. So Experiences and Sports combined have a value of $215b, which is above the current enterprise value of the entire company (c$200b). I’m not a big fan of the Sum of the Parts valuation method, but this simple calculation shows us there is potential value here.

Finally, the Entertainment segment has the largest revenues, but the lowest margin.

The $41b revenues are from Linear Networks ($11b), Direct-To-Consumer ($23b), and Content Sales/Licensing ($8b).

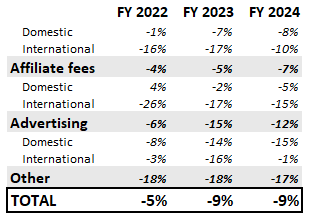

Linear network revenues are generated from affiliate fees, advertising, and other. Affiliate fees are payments Disney receives from cable, satellite, and other pay-TV providers for access to the Disney channels. Advertising is from selling commercial time on Disney linear TV channels, while Other is various smaller revenue streams not covered by the other categories, such as licensing and retransmission fees. Linear network revenues have declined -5%, -9%, and -9% respectively in the last 3 years.

As the table above shows, the decline from affiliate fees sourced domestically has accelerated (-8%) while international fees have declined at double-digit percentages in each of the last 3 years (-16%, -17%, -10%). A similar negative trend for advertising.

If this current trend continues, then by 2029, the entire segment could be irrelevant.

The loss of these revenues and profits needs to be made up elsewhere. That hope is placed on DTC.

Fortunately, DTC has increased revenues at a 15% CAGR over the last 3 years. That growth helped turn a negative operating profit that peaked at -$3.4b in 2022 to a small profit of $0.1b in 2024.

Growth was driven by an increase in subscribers and average monthly revenue generated per paid subscriber.

Subscribers (3-year CAGR)

Disney+ Domestic: 13%

Disney+ International: 16%

Hulu SVOD Only: 6%

Hulu Live TV + SVOD: 5%

Average Monthly Revenue per paid subscriber (3-year CAGR)

Disney+ Domestic: 8%

Disney+ International: 8%

Hulu SVOD Only: -1%

Hulu Live TV + SVOD Disney+ Hotstar: 5%

Disney is the no.2 player in streaming, and if history is any indication, a low single-digit growth in subscribers and a mid single-digit growth in revenue per subscriber will both increase revenues and expand margins. In other words, a 10% revenue CAGR along with an expansion of operating profit to 10% over the next 4 years will result in DTC completely replacing Linear Networks. If we factor in a slower Linear Networks decay, then DTC would need an even lower CAGR to supplement the lost revenue and profit.

So the nightmare scenario no longer looks as scary. We have 2 segments worth more than the entire business, and a 3rd segment which is already in turnaround mode. Should that turnaround continue, it will be a major catalyst for a re-rating of the stock.

Forecasts and DCF Valuation

Consensus estimates for revenue growth for the next three years are 3.5%, 5.5%, and 4.4%, respectively. I’m assuming the 4.4% continues until the end of the decade and a 4% growth into perpetuity. During the last 5 and 10 years, revenues grew at a 5.6% and 6.5% CAGR respectively. Operating margin is expected to expand to 18% by FY27, which is below the pre-COVID c25% margin. I keep that constant going forward for conservative purposes.

CAPEX is expected to be elevated in the next few years versus the past as the company guided for $8b in FY25 and announced back in 2023 a $60b CAPEX plan for the next decade. In Q1, the company announced a $1 dividend per share to be paid in FY25, and that it has repurchased $0.8b out of a planned $3b for FY25.

I get to a value of $114 with the assumptions mentioned, so the stock is trading at a discount to intrinsic value.

Furthermore, an expansion of margins beyond the current expectation will boost intrinsic value further, as shown below.

Disney’s IP is not only unmatched in the field of entertainment but also eternal with relaunches of characters and expansion of universes. The parks are on most people’s checklist of places to go. So while we haven’t discussed this, I consider the company to have a strong moat. A stock price below $90 is interesting in my opinion and will be considering a starter position. Let me know what you think in the comments. If you like my pieces, please subscribe so more people can find them!

Disclaimer: Not investment advice. Do your own work! This account is not operated by a broker, a dealer, a registered investment adviser, or a regulated entity. Under no circumstances does any information posted represent a recommendation to buy or sell a security. In no event shall the author be liable to anyone reading this post for any damages of any kind arising out of the use of any content available in this post. Past performance is a poor indicator of future performance. All the information on this substack and any related materials is not intended to be, nor does it constitute investment advice or a recommendation. All materials and information you obtain here are exclusively for informational purposes and do not constitute an offer or solicitation to provide any investment services to investors based in the U.S. or elsewhere.

Great analysis. I agree the business is undervalued.